Preparation of Common Size and Comparative Balance Sheet of a company by taking into account its financial results of two consecutive accounting years

Common Size and Comparative Balance Sheet

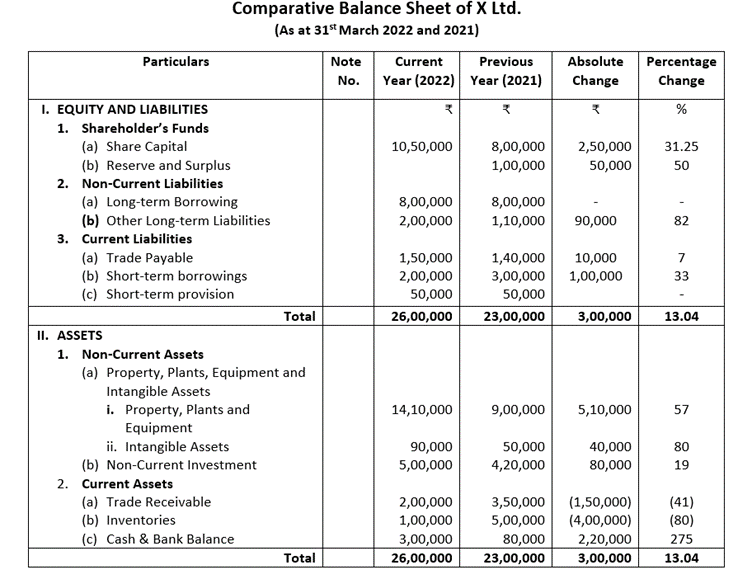

Comparative Balance Sheet :

The comparative balance sheet shows the different assets and liabilities of the firm on different dates to make a comparison of balances from one date to another. The comparative balance sheet has two columns for the data of the original balance sheets. A third column is used to show the change (increase/decrease) in the figures.

The fourth column may be added for giving percentages of increase or decrease. While interpreting a comparative Balance sheet the interpreter is expected to study the following aspects:

- Current financial position and Liquidity position

- Long-term financial position

- Profitability of the concern

- For studying the current financial position or liquidity position of a concern one should examine the working capital in both years. Working capital is the excess of current assets over current liabilities.

- For studying the long-term financial position of the concern, one should examine the changes in fixed assets, long-term liabilities, and capital.

- The next aspect to be studied in a comparative balance sheet is the profitability of the concern. The study of increase or decrease in profit will help the interpreter to observe whether the profitability has improved or not.

Common Size and Comparative Balance Sheet

Preparation of Comparative Balance Sheet

COMMENTS:

- The comparative balance sheet reveals that during 2022 there has been an increase in the share capital of the company by 31.25% of ₹ 2,50,000. It means that the company was in need of more funds for expansion. Issuing more shares reduces the Earning Per Share ratio of company.

- Reserve and surplus have increased from ₹1,00,000 to ₹1,50,000 that shows an increase in the profit i.e. 50%. It shows that the profitability of the Company has improved.

- Long term liabilities increase in form of secured loan then it show that company have good relationship with the banks in India and mostly it shows that the company depends on banks.

- Short-Term Provision remained unchanged which shows that company did not expect a hype in the losses in the future.

- Tangible assets have been raised 57% of ₹5,10,000. This change shows that company has made huge investment in Block capital structure.

- Intangible assets of the company have increased by 80% which represent that company has worked towards image building and goodwill.

- The liquid Assets that is case in hand, cash in bank shows an increase in 2022 over 2021 (of ₹ 2,20,000) this represents that the overall liquidity position of the concern.

- The Inventory has reduced by ₹4,00,000 , it shows that company has sold large quantity of its stock and overall business has improved.

- The overall financial position of the Company is satisfactory.

Common Size and Comparative Balance Sheet

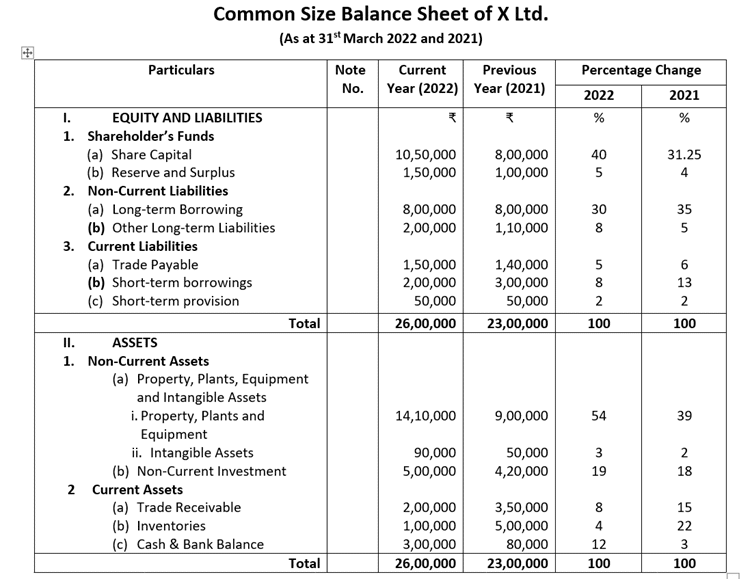

Common Size Balance Sheet

Common Size Balance sheet is a statement where balance sheet figures are expressed in the ratio of the common base of total assets or liabilities. Each asset to total assets and the ratio of each liability is expressed in the ratio of total liabilities is called common-size balance sheet.

Thus the common size statement may be prepared in the following way:

The total assets or liabilities are taken as 100 The individual assets are expressed as a percentage of total assets i.e. 100 and different liabilities are calculated in relation to total liabilities.

Preparation of Common Size Balance Sheet

ISC Common Size and Comparative Balance Sheet

COMMENTS:

- In the current year, it is to be noted that shareholder funds form 40% of the total outside liability and owner’s equity. The previous year it was 35% which represents that company has issued more shares for raising funds.

- Issuing shares rather than taking a long-term loan reduces the EPS of the company and shareholders will get less dividend. It represents the lack of proper management.

- In the year 2021, 35% of the total liabilities were formed by Long-term borrowing. It shows that the company’s funds were raised by shares and debentures in equal ratios. In the current year, the Outside long-term borrowing ratio decreased due to the issue of more shares.

- Creditors form only 6% of the total liabilities which shows that most transactions made are cash-based.

- In the current year, Tangible assets form 54% of the total Assets and this shows that a large amount of the company’s capital is invested in blocked funds. During 2021, tangible assets were 39% of the total assets.

- Overall company’s management has worked on balancing the structure of the company between debt and equity but has failed to do so.

Common Size and Comparative Balance Sheet

ISC Accounts Sample paper 2023-2

Admission of a partner-Important Questions-1

Important questions of fundamentals of partnership-3

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4

ISC 12 COMMERCE SAMPLE PAPER 2023