Table of Contents

Important questions of fundamentals of partnership-5

1. Interest on Capital

2. Interest on drawing

3. Profit and Loss Appropriation Account

4. Profit and Loss Appropriation Account and Partners Capital Account

5. Past Adjustment

6. Guarantee of Profit

Important questions of fundamentals of partnership-5

Past Adjustment:

Sometimes, after closing the accounts of the partnership firm at the end of the financial year, it is discovered that there had been some errors or omissions in the accounts.

In such cases, instead of altering the old accounts and the signed Balance Sheet an adjustment entry for such errors or omissions is made at the beginning of the next year.

Usually, the following types of adjustments are made:-

(i) Interest on Capital has been omitted.

(ii) Interest on Drawings has been omitted.

(iii) Interest on Capital and on Drawings have been provided at higher or lower rates than the rates agreed in the Deed.

(iv) Salary or commission to partners either not given or a higher or lower amount has been given.

(v) Profit shared in a wrong ratio.

Important questions of fundamentals of partnership-5

(i) Interest on Capital has been omitted:

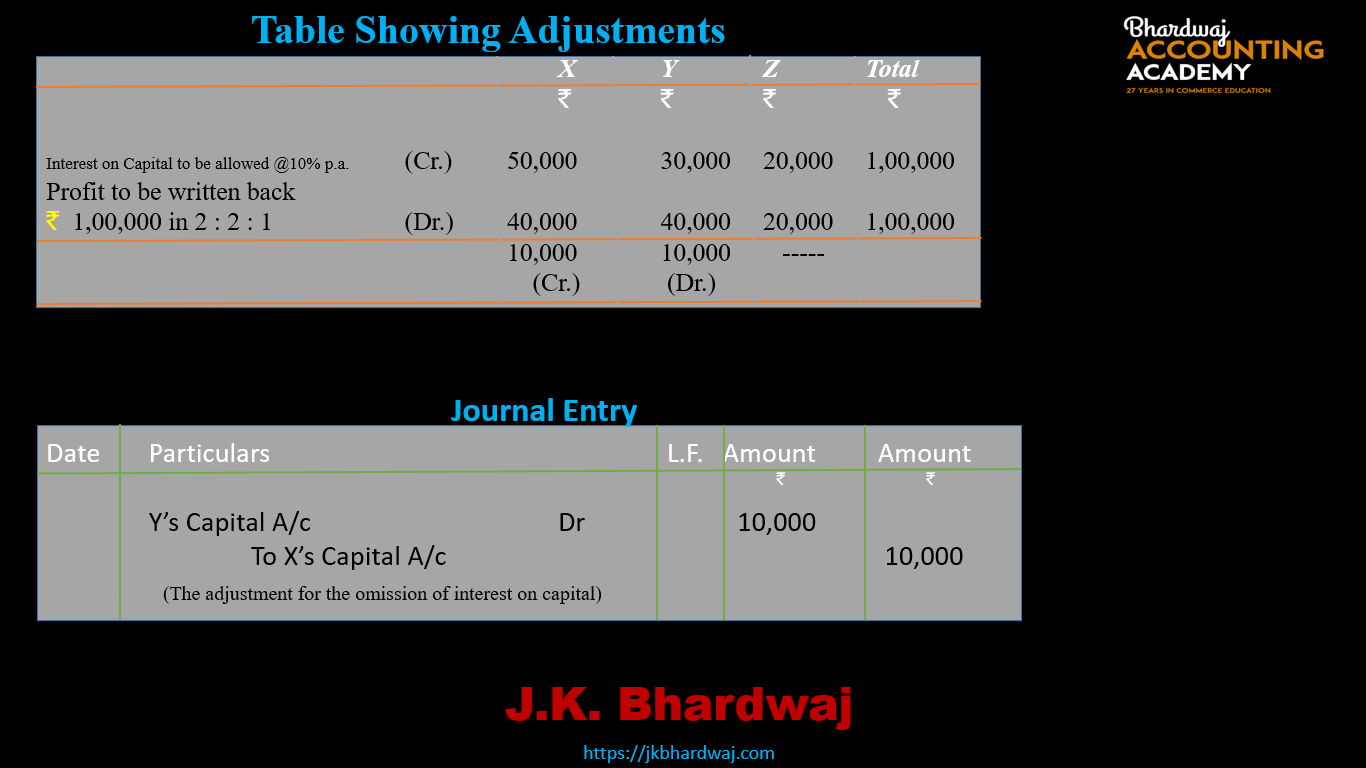

1. X, Y, and Z are partners sharing profits in the ratio of 2 : 2 : 1. Their capitals on 1st April 2019 were ₹ 5,00,000 ₹ 3,00,000 and ₹ 2,00,000 respectively. After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on capital at 10% p.a. was not provided before the distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet.

Pass the necessary journal entry assuming that capitals are not fixed.

Solution:

Working Note:-

Due to the omission of Interest on capital an excess amount of ₹1,00,000 (₹50,000+₹30,000+₹20,000) as profit has been credited (distributed) to the partner’s capital/ current account in their profit sharing ratio, which should have been distributed in the capital ratio ( in the form of interest on capital) ₹1,00,000 should be written back by debiting the partners capital/current account in their profit sharing ratio.

Important questions of fundamentals of partnership-5

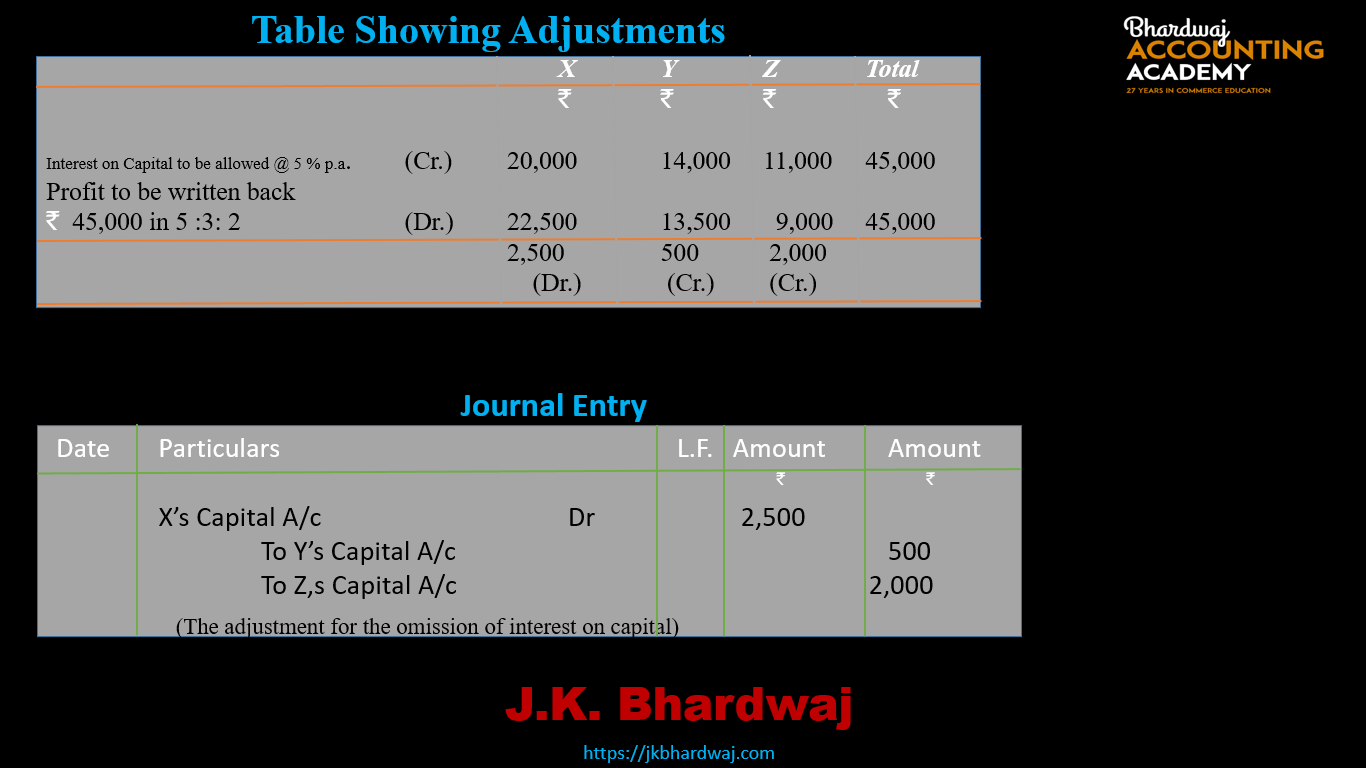

2. X, Y and Z are partners sharing profits in the ratio of 5 : 3 : 2 . Their capitals on 1st April 2019 were₹4,00,000 ₹ 2,80,000 and ₹ 2,20,000 respectively. After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on capital at 5% p.a. was not provided before the distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet.

Pass the necessary journal entry assuming that capitals are not fixed.

Solution:

Working Note:-

Due to the omission of Interest on capital an excess amount ₹45,000 (₹20,000+ ₹14,000+ ₹11,000) as profit has been credited (distributed) to the partner’s capital/ current account in their profit sharing ratio, which should have been distributed in the capital ratio( in the form of interest on capital) ₹45,000 should be written back by debiting the partners capital/current account in their profit sharing ratio.

Important questions of fundamentals of partnership-5

(ii) Interest on Drawings has been omitted:

1.X,Y, and Z are partners sharing profits in the ratio of 5 : 3 : 2 Their capitals on 1st April 2019 were ₹ 4,00,000 ₹ 3,00,000 and ₹ 2,00,000 respectively.

During the year their drawings were₹ 20,000, ₹ 15,000, and ₹ 10,000 respectively.

After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on drawing ₹ 1,000, ₹ 750, and ₹250 respectively was not charged, before distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet. Pass the necessary journal entry.

Solution:

2. X, Y, and Z are partners sharing profits in the ratio of 4 : 3 : 3 Their capitals on 1st April 2019 were ₹ 4,00,000 ₹ 3,00,000, and ₹ 2,00,000 respectively.

During the year their drawings were ₹40,000, ₹ 30,000, and ₹20,000 respectively.

After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on drawing ₹ 2,000, ₹ 1,500, and ₹ 1,000 respectively was not charged, before the distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet. Pass the necessary Journal Entry.

Solution:

Important questions of fundamentals of partnership-5

(iii) Interest on Capital and Interest on Drawings have been provided at higher or lower rates than the rates agreed in the Deed:

1. A, B, and C are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their capitals were ₹ 30,00,000; ₹20,00,000 and ₹ 10,00,000 respectively.

Interest on capital for the year ended 2020 was credited to them @ 5% p.a. instead of 10% p.a. The profit for the year before charging interest was ₹ 20,00,000. Prepare necessary adjustment entry.

2. A, B, and C are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their capitals were ₹ 30,00,000; ₹ 20,00,000 and ₹ 10,00,000 respectively.

Interest on capital for the year ended 2020 was credited to them @ 6% p.a. instead of 10% p.a. The profit for the year before charging interest was ₹ 15,00,000. Prepare necessary adjustment entry.

Important questions of fundamentals of partnership-5

(iv) Salary or commission to partners either not given or a higher or lower amount has been given:

1.Ram and Ramesh were partners in a firm sharing profits in the ratio of 3 : 2. Their respective capitals were Ram ₹ 8,50,000 and Rahim ₹ 6,50,000 On 1st April 2019. During the year their drawings were ₹ 30,000, ₹ 20,000 respectively.

The partnership deed provided for the following :

- Interest on Capital @ 10% p.a.

- Ram’s Salary ₹6,000 per month and Ramesh’s salary is ₹ 4,000 per Month.

- Interest charged on Drawing @ 6% p.a.

The profit for the year ended 31st March,2020 distributed without providing for the above. Pass the adjustment entry.

Important questions of fundamentals of partnership-5

(v) Profit shared in a wrong ratio:

1. A ,B and C are partners in a firm .capital accounts on 1 april 2019 stood at ₹ 2,00,000 , ₹ 1,00,000 and ₹1,00,000. Each partner withdrew ₹10,000 during the FY 2019-2020.

As per the provisions of the Partnership deed-

- ‘B’ was entitled to a salary of ₹ 2,000 p.m.

- Int. on capital was to be allowed @ 10 % p.a.

- Int. on drawings was to be charged @ 4% p.a.

- Profits and losses were to be shared in the ratio of their capital.

- ‘C’ was entitled to a Commission of ₹ 10,000

The net profit of ₹90,000 for the year ended 31st march 2020 was divided equally amongst the partners without providing for the terms of the Partnership deed.

Pass the single adjusting journal entry to rectify the error.

2.Ram and Ramesh were partners in a firm sharing profits in the ratio of 3 : 2. Their respective capitals were Ram ₹ 8,00,000 and Rahim ₹ 6,00,000 On 1st April 2019.

During the year their drawings were ₹30,000, and ₹ 20,000 respectively.

The partnership deed provided for the following :

- Interest on Capital @ 5% p.a.

- Ram’s Salary ₹6,000 per month and Ramesh’s salary ₹ 4,000 per Month.

The profit for the year ended 31st March 2020 was ₹ 5,50,000 which was distributed equally, without providing for the above. Pass the adjustment entry.

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5