ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Maximum marks: 80

Time allowed: Three Hours

SECTION A (60 Marks)

Answer all the questions.

Question 1

In subparts (i) to (viii) chose the correct option and in subparts (ix) to (x) answer the questions as instructed.

(i) Mohit Ltd. (an unlisted Non-NBFC) redeems its 8,000, 10% Debentures of ₹ 100 each in installments as follows: [1]

Date of Redemption Debentures to be redeemed

31st March, 2020 3,000

31st March, 2021 1,000

31st March, 2022 4,000

On the basis of the above details, what will be the amount of Debenture Redemption Reserve which the company will transfer to General Reserve on 31st March, 2022?

(a) ₹ 80,000

(b) ₹ 30,000

(c) ₹ 10,000

(d) ₹ 40,000

(ii) Which of the following transactions is debited to Realization Account? [1]

(a) Increase in the value of Building

(b) Increase in Provision for Doubtful Debts

(c) Creditors discharged at a discount

(d) Loss on revaluation of all assets and reassessment of all liabilities

(iii) Anita and Binita are partners in a firm. Anita had taken a loan of ₹ 20,000 from the firm. How will Anita’s loan be closed in the event of dissolution of the firm? [1]

(a) By crediting it to Anita’s Capital Account

(b) By debiting it to Anita’s Capital Account

(c) By crediting it to Realisation Account

(d) By debiting it to Cash Account

(iv) Praveen and Abha are partners, sharing profits in 3:2. Ajay is admitted for 1/5th share and he brings in ₹ 84,000 as his share of goodwill which is credited to the capital accounts of Praveen and Abha respectively with ₹33,000 and ₹11,000. New Profit-sharing ratio will be: [1]

- 5:3:3

- 7:7:6

- 7:9:4

- 9:7:4

(v)Assertion (A): ‘Y’ wants that profits should be distributed in the ratio Of capitals as he has invested more capital than ‘X’. This dispute arises as the partnership deed was not there.

Reason (R): As there is no partnership deed Indian Partnership Act, 1932 applies and as per act, profits are to be distributed equally. [1]

(a) Both A and R are true and R is the correct explanation of A.

(b) Both A and R are true but R is not the correct explanation of A

(c) A is true and R is false

(d) A is false and R is true

(vi) Gyan Ltd. Forfeited 150 shares of ₹10 each. Issued at par for nonpayment of the final call of ₹3. Out of these 75 shares were re-issued at ₹12 per share. How much amount would be transferred to the capital reserve? [1]

- ₹1,050

- ₹525

- ₹900

- ₹500

(vii) Securities Premium reserve can be utilized for: [1]

- Buy back of its own share

- Writing off preliminary expenses of the company

- Providing for the Premium payable on the redemption of any redeemable Preference share

- Issuing fully paid bonus share to shareholders

- All of these

(viii) At the time of dissolution of a firm, creditors are ₹90,000. The firm’s capital stood at ₹1,50,000. Cash balance is ₹20,000. Other assets realized ₹2,70,000. Gain/Loss in the realization account will be: [1]

- ₹40,000 (Gain)

- ₹50,000 (Loss)

- ₹50,000 (Gain)

- ₹40,000 (Loss)

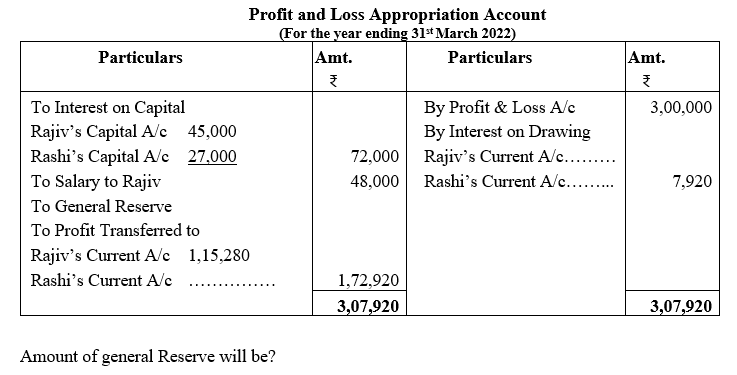

(ix) Rajiv and Rashi are partners in a firm sharing profit and losses in the Ratio of 2: 1. Their fixed capitals are 5,00,000 and 3,00,000 respectively, interest on capital is allowed @ 9% p.a. while interest on Drawings is charged @ 12% p.a. Rajiv is allowed a salary of ₹4,000 per month. Interest on Y’s loan of ₹2,00,000 is to be provided @ 6% p.a. During the year ended 31 March 2022, Rajiv’s Drawings were ₹60,000 and Rashi’s Drawings were ₹72,000. 5% of the net profit is to be transferred to General Reserve. Profit and Loss Appropriation account for the year ended 31st March 2022 given below:

(x) A, B and C are partners in a firm sharing profit/loss in the ratio of 2:2:1. On March 31, 2018, C died. Accounts are closed on Dec., 31 every year. The sales for the year 2017 was Rs.6,00,000 and the profits were Rs.60,000. The sales for the period from Jan. 1, 2018 to March 31,2018 were Rs.2,00,000. The share of the deceased partner in the current year’s profits on the basis of sales is: [1]

(a) Rs.20,000

(b) Rs.3,000

(c) Rs. 8,000

(d) Rs. 4,000

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Admission of a partner-Important Questions-3

Question 2 [3]

A and B are partners in a firm with the capital balances of ₹ 3,60,000 and ₹ 2,40,000 respectively, Sharing profits and losses in the ratio of 3:2. They admitted C into the firm for the 1/5th share of profits. He brings ₹ 2,50,000 as capital. The firm had a general reserve of ₹ 70,000 and an Undistributed Profit ₹ 30,000 at the time of admission of C. Calculate the firm’s goodwill and C’s share of goodwill.

Question 3 [3]

The profits for the last five years of a firm were as follows –

year 2013-14 ₹ 1,92,000;(Including Abnormal Gain ₹ 15,000 on profit on the sale of fixed assets)

year 2014-15 ₹ 95,000; (After debiting Loss of stock by fire ₹75,000)

year 2015-16 ₹ 1,23,000;(Including interest on Non-trade Investment ₹ 10,000) (Closing Stock undervalued by 10,000 at the end of the financial year 2016)

year 2016-17 ₹ 1,30,000.

Calculate the value of goodwill of the firm on the basis of 1 years purchase of average profit for the last four years.

Admission of a partner-Important Questions-5

Question 4 [3]

A ,B and C are partners in a firm .capital accounts on 1 April 2019 stood at ₹ 2,00,000 , ₹ 2,00,000 and ₹1,00,000.

Each partner withdrew 20,000 during the FY 2019-2020. As per the provisions of the Partnership deed-

- B was entitled to a salary of ₹ 2,500 p.m.

- on capital was to be allowed @ 6 % p.a.

- on drawings was to be charged @ 5% p.a.

- Profits and losses were to be shared in the ratio of their capitals.

- C was entitled to a Commission ₹ 10,000.

The net profit of ₹ 1,20,000 for the year ended 31st march 2020 was divided equally amongst the partners without providing for the terms of the Partnership deed. What journal entry will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed.

Admission of a partner-Important Questions-4

Question 5 [3]

Ram, Mohan and Sohan are partners with capitals of ₹ 5, 00,000, ₹ 3, 00,000 and ₹ 2, 40,000 respectively. After providing interest on capital @10% p.a. the profits are divisible as follows: Ram1/2, Mohan 1/3 and Sohan 1/6. Ram and Mohan have guaranteed that Sohan’s share in the profit shall not be less than ₹ 25,000, in any year. The net profit for the year ended March 31, 2022 is ₹ 2,00,000, before charging interest on capital. You are required to show the distribution of profit.

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Question 6 [6]

B.G. Ltd. issued 10,000, 6% debentures of ₹100 each at 5 % discount on 1st April 2021. The issue was fully subscribed. Redeemable after 5 year at 10 % Premium.

According to the terms of issue, interest on debentures is payable half yearly on 30th September and 31st Mach and tax deducted at source is 20%. Pass necessary journal entries For financial Year 2021-22.

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Question 7 [6]

The book value of assets (other than cash and bank) transferred to Realisation Account is Rs. 1,00,000. 50% of the assets are taken over by a partner Atul, at a discount of 20%; 40% of the remaining assets are sold at a profit of 30% on cost; 5% of the balance being obsolete, realised nothing and remaining assets are handed over to a Creditor, in full settlement of his claim. You are required to record the journal entries for realisation of assets.

Question 8 [6]

From the information of Prudence Ltd. given below, you are required to show how the relevant items will appear in the company’s Balance Sheet (an extract) as at 31st March 2022.

The Authorized capital of Prudence Ltd. consisted of 3,000, 10% Preference Shares of

₹ 100 each and 8,000 Equity Shares of ₹100 each, out of which:

- 1,000, 6% Preference shares were issued to the public, fully called and paid up

- 3,000 Equity shares were issued which were fully called

- There were arrears of ₹ 20 per share on 400 Equity+

| Particulars | (₹) |

| Mortgage Debentures | 50,000 |

| Bank Overdraft | 25,000 |

| Balance in Statement of P/L (Dr) | 76,000 |

| Freehold Property | 50,000 |

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Important questions of fundamentals of partnership-5

Question 9 [10]

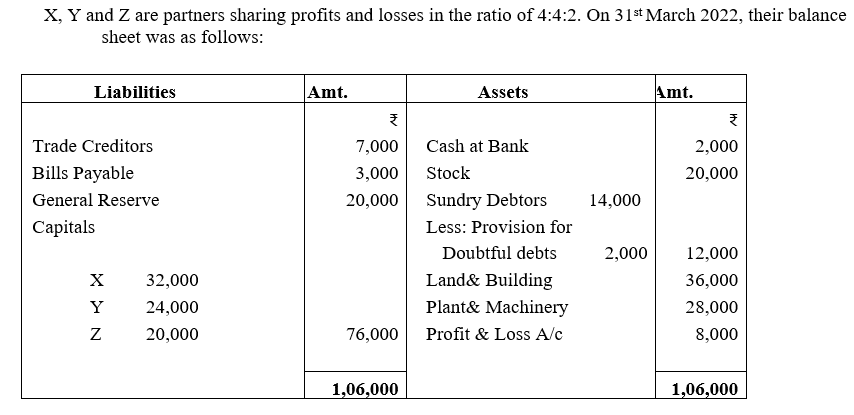

X, Y and Z are partners sharing profits and losses in the ratio of 4:4:2. On 31st March 2022, their balance sheet was as follows:

On 1st April 2022, W Admitted for1/5 share of profit in the firm on the following terms:

- W bring ₹25,000 as capital and ₹10,000 for his share of goodwill.

- Stock, Land & Building is to be appreciated by 10%

- Plant & Machinery reduced by 10%.

- Sundry Debtors are considered to be good.

- Provision for legal charges to be made at ₹2,000.

- Capital Account is adjusted on the basis of W capital Any excess and deficiency Adjusted through the Current account.

Prepare Revaluation Account, Partner’s Capital Account and Balance Sheet of the new firm.

Important questions of fundamentals of partnership-2

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Question 10 [10]

BHARDWAJ Ltd. invited applications for issuing 2,40,000 equity shares of Rs 10 each at a premium of Rs 4 per share. The amount was payable as under:

On application – Rs 4 per share (including premium Rs 2)

On allotment – Rs 4 per share

On first and final call Rs 6 per share (including premium Rs 2) Applications for 3,00,000 shares were received and pro-rata allotment was made to all the applicants.

Excess application money received on application was adjusted towards sum due on allotment. All calls were made and were duly received except from Rohini, who failed to pay allotment and first and final call on 7,500 shares applied by her.

These shares were forfeited. Afterwards, 40% of the forfeited shares were reissued at Rs 11 per share as fully paid up. Pass necessary Journal entries in the books of the company.

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Hidden Goodwill at the time of Admission of A New Partner

SECTION B (20 Marks)

Answer all questions

Question 11

In subparts (i) and (ii) chose the correct option and in subparts (iii) to (v) answer the questions as instructed.

(i) Main Objective of Analysis of Financial Statement is: [1]

(a) To know the financial strength

(b) To make a comparative study with other firms

(c) To know their efficiency of management

(d) All the above

(ii) Opening Inventory of a firm is Rs 80,000. Cost of revenue from operation is Rs 6,00,000. Inventory Turnover Ratio is 5 times. Its closing inventory will be: [1]

(a) Rs 1,60,000

(b) Rs 1,20,000

(c) Rs 80,000

(d) Rs 2,00,000

(iii) Unclaimed dividend appears in the balance sheet of the company under the sub head? [1]

(iv) The Quick Ratio of a company is 0.8:1. State whether the Quick Ratio will improve, decline or will not change in the following cases : [1]

(i) Cash collected from Debtors ₹ 50.000.

(ii) Creditors of ₹ 20,000 paid off.

(v) State with reason whether Issue of debentures to the vendors for purchase of machinery lead to inflow, outflow or no flow of Cash and Cash Equivalents. [1]

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Question 12 [3]

You are required to prepare a Common size Statement of Profit & Loss from the following particulars of Nishant Ltd.

| Particulars | N. No. | 31.03.2022 (₹) | 31.03.2021 (₹)

|

| Revenue from operations | 20,00,000 | 15,00,000 | |

| Cost of raw materials consumed | 12,00,000 | 9,00,000 | |

| Employee benefit Expenses | 4,00,000 | 3,00,000 | |

| Rate of tax | 30% | 30% |

Important questions of fundamentals of partnership-3

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Question13 [2+2+2]

- Q Ltd. has a 6% long-term loan of ₹ 5,00,000 and 10 % Long term loan ₹ 7,00,000. Its net profit after interest and tax was ₹ 4,80,000. Rate of tax 40 %. Calculate interest coverage ratio.

- Calculate the current ratio from the following :

Total Assets ₹9,00,000

Non-Current Investment ₹3,00,000

Fixed Assets ₹4,00,000

Shareholders Fund ₹5,00,000

Non-Current Liabilities ₹2,50,000

(c) The debt-equity ratio of a company is 1:1 state giving reasons, (any two) which of the following would improve, reduce or not change the ratio

(i) Purchase of machinery for cash

(ii) Purchase of goods on credit

(iii) Sale of furniture at cost

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Admission of a partner-Important Questions-1

Question 14 [3+3]

From the following extracts of a company’s Balance Sheets, you are required to calculate:

- Cash from Investing

- Cash from Financing Activities

| Particulars | 31.3.2022 (₹) | 31.3.2021 (₹) |

| Equity Share Capital | 15,00,000 | 12,00,000 |

| 5% Debentures | 10,00,000 | 8,00,000 |

| Securities Premium Reserve | 50,000 | 10,000 |

| Plant & Machinery (at cost) | 10,90,000 | 9,00,000 |

| Accumulated Depreciation | 3,00,000 | 4,00,000 |

| 10% Investments | 60,000 | 50,000 |

| Goodwill | 1,00,000 | 70,000 |

Note: Dividend proposed in the years 2020-21 and 2021-22 were ₹ 42,000 and ₹ 40,000 respectively.

Additional information:

During the year 2021-22, the company:

- Issued the 5% Debentures at a discount of 10% on 1st April, 2021. The discount on issue of Debentures was written off from Securities Premium Reserve.

- Provided depreciation of ₹ 1,00,000 on Plant and

- Sold Plant and Machinery, the book value of which was ₹ 5,00,000 for ₹ 4,50,000.(ISC specimen paper)

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE

Format of Profit and loss Appropriation Account

Important questions of fundamentals of partnership

Goodwill questions for practice Class 12 ISC & CBSE

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

ISC ACCOUNTS MODEL TEST PAPER FOR PRACTICE