ISC accounts questions for practice

ISC accounts questions for practice

Question 1.

RACHIT Ltd. was registered with an authorised capital of ₹50,00,000 divided into 5,00,000 Equity Shares of ₹10 each. The company offered 50,000 shares to the public at a premium of ₹2 per share, payable as follows: ₹ 4 on application and Allotment and,

Balance on first and final call (with Premium)

Applications were received for 80,000 shares .

The applicants of 60,000 shares were allotted 50,000 shares on a pro-rata basis.

The applicants of 20,000 shares were rejected and money was returned.

Nobby, a shareholder who had applied for 1,200 shares failed to pay the first and final call money his shares were forfeited and reissued at 10% discount.

You are required to Pass journal entries to record the above transactions in the books of the company.

Question 2.

A and B, each doing business as sole proprietors, started a partnership on 1 April 2018. A brought in Plant and Machinery valued at ₹6,00,000 whereas B brought in furniture costing ₹1,00,000 and ₹7,00,000 in cash. Since the business needed more funds, B gave a loan of ₹2,00,000 to the firm on 30th June, 2018.

Their partnership deed provided for:

(a) Interest on capital to be allowed @10% per annum.

(b) Interest on drawings to be charged @ 6% per annum.

(c) A to be given a commission of 4% on the corrected net profits before charging a commission.

(d) B is to be given a salary of ₹9,000 per annum.

(e) Profit sharing Ratio 3:2.

B withdrew ₹5,000 at the end of every month and A withdrew ₹30,000 on 1st August,2018.

The net profit of the firm, for the year 2018-19, after debiting B’s salary of ₹9,000 per annum but before considering any interest due to and due from the partners, was ₹4,00,000.

You are required to prepare for the year 2018-19:

(i) Profit and Loss Appropriation Account.

(ii) Partners’ Capital Accounts.

ISC accounts questions for practice

Question 3.

On March, 31, 2022 the balance in the capital accounts of Sonu, Monu and Tony, after making adjustments for profits. drawing, etc. were ₹9,00,000. ₹7,00,000 and ₹ 5,00,000 respectively.

Subsequently, it was discovered that interest on capital and interest on drawings had been omitted.

The partners were entitled to interest on capital @ 5 p.a.

The drawings during the year were Sonu ₹ 2,00,000; Monu ₹1,50,000 and Tony, ₹ 90,000.

Interest on drawings, chargeable to partners were Sonu ₹ 5000, Monu ₹3600 and Tony ₹ 2000.

The net profit during the year amount to ₹ 2,40,000, The Profit sharing

ratio was 3:2:1. Record necessary adjustment entry.

Question 4.

X and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. Z is admitted as a new partner for 3/13th share in the profits.

Z contributed the following assets towards his capital and for his share of goodwill.

Land ₹ 90,000;

Machinery ₹ 90,000;

Stock ₹ 60,000;

Debtors ₹60,000.

On the date of admission, the Goodwill of the firm is valued at ₹5,20,000. Journalize the above transaction.

Admission of a partner-Important Questions-1

ISC accounts questions for practice

Question 5.

Pass the necessary journal entries on the dissolution of a firm in the following cases:

A) Bills receivable of ₹ 20000 discounted with the bank is dishonoured as drawee was declared insolvent and 30% amount is received in cash from him.

B) 100 shares of Bajaj Auto Ltd. acquired at a cost ₹3,600 had been written of from the books. These were valued at Rs. 12 par share, and were divided among partner’s A and B in 2 : 1.

C) Mr. Verma, a creditor to whom ₹ 6,000 are due, accepted office equipment at ₹ 4,000 and the balance paid to him by cash.

D) Debtors of₹ 5,00,000 and provision for doubtul debts of ₹ 20,000 transferred to realisation account. On dissolution bad debts were ₹ 1,00,000 and remaining debtors realised at 30% discount.

E) Loan owed by B towards firm is ₹ 30,000. It was decided by the firm that B will pay to the creditor ₹ 25,000 in settlement of his loan.

F) The firm had borrowed ₹ 35,000 from Rashmi, a partner. The firm got dissolved; Rashmi decided to take furniture against the payment of her loan.

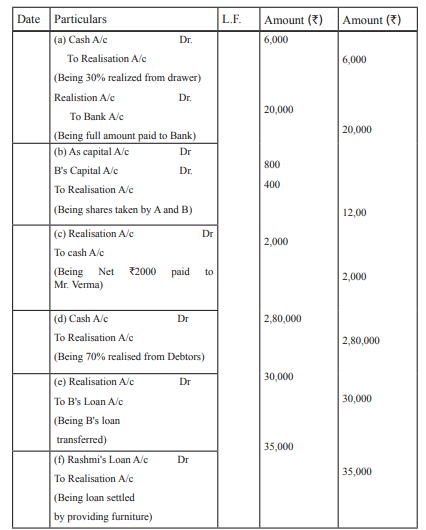

Solution:

Journal Entries

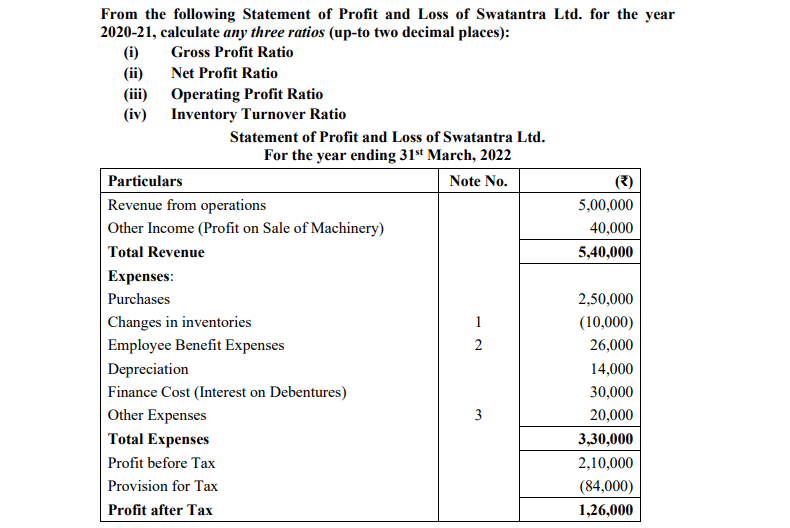

Question 6.

Jay Company Ltd. forfeited 500 shares of ₹10 each, fully called up on which ₹7 have been received and final call of ₹ 3 per share remains unpaid. These shares were later on reissued for ₹ 9 per share fully paid up. Make journal entries for recording the forfeiture and reissue of shares.

ISC accounts questions for practice

Question 7.

MOHIT Ltd issued 5000, 10% Debentures of ₹100 each payable as:

₹30 on application,

₹ 40 on allotment and,

Balance on First and final call.

Applications were received for 8000 debentures. Applicants for 200 debentures were sent letter of regret and money was returned.

Allotment was made proportionately to the remaining applicants. Oversubscription was applied to the amount due on allotment.

Remaining amount was duly received.

Make journal entries for the above transactions in the books of the company.

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Question 8.

BHARAT Ltd. purchased machinery for ₹ 3,96,000 and issued 9% debentures of ₹ 100 each to the vendors. Make journal entries if the debentures were issued

(a) at par.

(b) at a premium of ₹ 10 each.

(c) at a discount of ₹10 each.

ISC accounts questions for practice

Question 9.

Pass journal entries if 1000, 9% debentures of ₹500 each have been issued as :

(i) Issued at ₹ 500, redeemable at ₹ 500

(ii) Issue at ₹ 450; redeemable at ₹500

(iii) Issued at ₹ 520; redeemable at ₹ 500

(iv) issued at ₹500; redeemable at ₹ 560

(v) Issued at ₹ 480; redeemable at ₹ 530

Question 10.

SARITA Ltd. supplies you following information regarding the year ending 31st,March 2022.

Cash sales ₹1,60,000

Credit sales ₹4,50,000

Return inward₹10,000

Opening inventory ₹ 70,000

Closing inventory ₹ 1,10,000

Gross profit ratio is 25%.

Calculate inventory turnover ratio.

ISC accounts questions for practice

Admission of a partner-Important Questions-5

Question 11.

Venus Ltd’ was registered with an authorised capital of ₹ 40,00,000 divided into 4,00,000 equity shares of 10 each. 70,000 of these shares were issued as fully paid to ‘M/s. Star Ltd.’ for building purchased from them. 2,00,000 shares were issued to the public and the amounts were payable as follows:

On Application – ₹ 3 per share

On Allotment – ₹ 2 per share

On First Call – ₹ 2 per share

On Second and Final Call – ₹ 3 per share

The amounts received on these shares were as follows:

On 1,00,000 shares – Full amount called

On 60,000 shares – ₹ 7 per share

On 30,000 shares – ₹ 5 per share

On 10,000 shares – ₹ 3 per share

The directions forfeited 10,000 shares on which only ₹ 3 per share were received. These shares were reissued at ₹ 12 per share fully paid. Pass necessary journal entries for the above transactions in the books of ‘Venus Ltd’. (CBSE Compt. 2019)

Question 12.

Rolga Ltd. is having an authorized capital of ₹ 50,00,000 divided into equity shares of ₹ 100 each. The company offered 42,000 shares to the public. The amount payable was as follows:

On Application – ₹ 30 per share

On Allotment – ₹ 40 per share (including premium)

On First and Final Call – ₹ 50 per share

Application were received for 40,000 shares.

All sums were duly received except the following:

Lai, a holder of 100 shares did not pay allotment and call money.

Pal, a holder of 200 shares did not pay call money.

The company forfeited the shares of Lai and Pal. Subsequently the forfeited shares were reissued for ₹ 70 per share as fully paid-up. Show the entries for the above transactions in the cash book and journal of the company. (CBSE Delhi Compartment 2015)

ISC accounts questions for practice

Question 13.

The profits for the last five years of a firm were as follows –

year 2013-14 ₹ 1,92,000;(Including Abnormal Gain ₹ 15,000 on profit on the sale of fixed assets)

year 2014-15 ₹ 95,000; (After debiting Loss of stock by fire ₹75,000)

year 2015-16 ₹ 1,23,000;(Including interest on Non-trade Investment ₹ 10,000)

year 2016-17 ₹ 1,30,000. (Closing Stock overvalued by 10,000 at the end of the financial year 2017)

Calculate the value of goodwill of the firm on the basis of 2 years purchase of average profit for the last four years.

Important questions of fundamentals of partnership-3

Question 14.

Karan and Vijay are partners in a firm sharing profits and losses in the ratio of 4:3. They admit Shrey for 𝟏 𝟑 ⁄ share in the profits. On the date of Shrey’s admission:

(a) The capitals of Karan and Vijay are: ₹ 40,000 and ₹ 30,000 respectively.

(b) Profit and Loss Account has a debit balance of ₹ 7,000.

(c) General Reserve shows a balance of ₹ 21,000 which is not to be disturbed.

(d) Goodwill of the firm is valued at ₹ 42,000.

(e) The cash at bank is ₹ 15,000.

(f) Shrey brings in proportionate capital and his share of goodwill in cash.

You are required to prepare:

(i) Partners’ Capital Accounts.

(ii) Cash at Bank Account of the reconstituted firm on the date of Shrey’s admission

ISC accounts questions for practice

Question 15.

Question 16.

BHARAT Ltd. made a profit of ₹ 2,00,000 after considering the following items:

Depreciation of fixed assets ₹ 20,000

Writing off preliminary expenses ₹ 10,000

Loss on sale of furniture ₹5,000

Provision of Taxation ₹1,60,000

Transfer to General reserve ₹40,000

Profit on sale of Machinery ₹6,000

The following additional information is available to you:

Particulars 31.03.2021 (₹ ) 31.03.2022 (₹ )

Debtors 24,000 30,000

Creditors 20,000 30,000

Bills Receivables 20,000 17,000

Bills Payables 16,000 12,000

Prepaid Expenses 400 600

Calculate Cash Flow from Operating Activities.

COMPREHENSIVE PROJECT OF NOT-FOR-PROFIT ORGANISATIONS

Question 17.

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information: Opening Debtors ₹38,000

Opening Bills Receivable ₹12,000

Closing Debtors ₹ 30,000

Closing Bills Receivable ₹20,000

Total Revenue From Operation₹ 15,00,000

Cash Revenue From Operation₹ 5,00,000

ISC accounts questions for practice

Question 18.

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-4

Karan and Vijay are partners in a firm sharing profits and losses in the ratio of 4:3. They admit Shrey for 1/3 share in the profits.

On the date of Shrey’s admission: (a) The capitals of Karan and Vijay are: * 40,000 and 30,000 respectively.

(b) Profit and Loss Account has a debit balance of 7,000.

(c) General Reserve shows a balance of 21,000 which is not to be disturbed.

(d) Goodwill of the firm is valued at 42,000. (e) The cash at bank is 15,000.

(f) Shrey brings in proportionate capital and his share of goodwill in cash.

You are required to prepare:

(i) Partners’ Capital Accounts.

(ii) Cash at Bank Account of the reconstituted firm on the date of Shrey’s admission.

I want this question solution