Table of Contents

ISC ACCOUNTS Sample paper 2023

ISC ACCOUNTS Sample paper 2023

ACCOUNTS

Class-XII

Maximum Marks: 80

Time Allowed: Three hours

The Question Paper contains three sections.

Section A is compulsory for all candidates.

Candidates have to attempt all questions from either Section B or Section C.

There are internal choices provided in each section.

The intended marks for questions or parts of questions are given in the brackets [].

All calculations should be shown clearly.

All working, including rough work, should be done on the same page as, and

adjacent to, the rest of the answer.

SECTION A (60 Marks)

Answer all questions.

Question 1 [1]

A company forfeits 1,000 shares of ₹ 10 each. It had received ₹ 6,000 on these shares.

What is the maximum discount that can be allowed by the company on the reissue of 400

shares?

(a) ₹4,000

(b) ₹400

(c) ₹2,400

(d) ₹ 1,600

Question 2 [1]

Which of the following groups not included a company could issue shares for consideration other than cash?

(a) Issue of shares to promoters

(b) Issue of shares to Underwriter

(c) Issue of shares to Vendors

(d) Issue of shares to the General public for cash

Question 3 [1]

Bharat Ltd. (a listed NBFC) has 40,000, 5% Debentures of ₹100 each due for redemption at

par on 31st March 2022.

The Debenture Redemption Investment which was purchased on 30th April, 2021, was

realized on the date of redemption at 111% less 1% brokerage, and the debentures were

redeemed.

You are required to calculate the sale price of the Debenture Redemption Investment.

ISC ACCOUNTS Sample paper 2023

Question 4 [1]

What is the object of the realization account?

(a) Close the books of accounts

(b) To determine the profit or loss on realization of assets and payment of liabilities.

(c) To determine the profit or loss on revaluation of assets and reassessment of liabilities.

(d) a and b

Question 5 [1]

At the time of retirement of a partner, Loss on revaluation of assets and reassessment of liabilities should be Debited to …

(a) All partner’s capital account in their old ratio

(b) Retiring partner’s capital account in his/her sacrificing ratio

(c) Remaining partner’s capital account in their new ratio

(d) None of these

ISC ACCOUNTS Sample paper 2023

Question 6 [1]

The formula for valuing goodwill under the Capitalisation of Super Profits method is:

(a) Super profit made by the firm multiplied by the normal rate of return

(b) Capital Employed by the firm multiplied by the normal rate of return

(c) Capitalised profit of the firm divided by the rate of return

(d) Super profit made by the firm divided by the normal rate of return

Question 7 [1]

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admit C as a new partner for 1/5 share of profit. Investment Fluctuation reserve ₹45,000.

Book Value of Investment ₹60,000. The market value of Investment at the time of admission of ‘C’ ₹45,000. What Journal entry will be passed in the books of the firm?

Question 8 [1]

A, B, and C are partners in a firm sharing profits and losses in the ratio of 3:2:1. C retires from the firm and his share is purchased by A and B in the ratio of 1:1 New Profit sharing ratio between A and B respectively would be:-

(a) 1:1

(b) 2:2

(c) 7:5

(d) 3:2

Question 9 [1]

P and Q are partners in a firm sharing profits and losses in the ratio of 3:2. They admit R as a new partner for 1/4 share of profit.

Workmen Compensation Reserve ₹35,000.

Provision for Workmen Compensation Claim ₹25,000. What Journal entry will be passed in the books of the firm?

Question 10 [1]

The Share of Goodwill of the retiring partner is debited to remaining partners in their…

(a) Sacrificing Ratio

(b) Gaining Ratio

(c) New Ratio

(d) Old Ratio

ISC ACCOUNTS Sample paper 2023

Question 11 [3]

Kavi, Dhruv and Parth are partners in a firm sharing profits and losses in the ratio of 3:1:1.

Balance Sheet of Kavi, Dhruv and Parth (extract) As at 31st March, 2022

| Liabilities | (₹) | Assets | (₹) |

| – | – | Bank | 25,000 |

On Kavi’s retirement from the firm on 1st April 2022, the amount due to him is determined at ₹ 76,000. The firm took a sufficient loan from the bank on the mortgage of the firm Building to pay the amount due to Kavi.

You are required to pass the necessary journal entries to pay the amount due to Kavi.

OR

BHARAT Ltd issued for public subscription 40,000 equity shares of Rs. 10 each. Application received for 50,000 shares. 40,000 shares allotted to 50,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. Amount payable as under:

On application Rs. 3 per share,

on allotment Rs. 4 per share,

on first and Final call Rs. 3 per share.

All duly money received.

Pass journal entries in the books of the company.

ISC ACCOUNTS Sample paper 2023

Question 12 [3]

Reena and Meena are partners in a firm. They admit Teena on 1st April, 2022, for 1⁄4 share in the profits of the firm. On average, the profits earned by Reena and Meena are ₹ 51,000.

The average capital employed by the firm is ₹ 2,50,000.

The normal rate of return in the industry is 10%.

It is decided to value goodwill on the basis of four years’ purchase of profits in excess of profits @ 10% on the money invested.

You are required to:

(i) Calculate the goodwill of the firm.

(ii) Pass the journal entries in the books of the firm if Teena brings into the firm her share of goodwill in cash.

Or

The Hindustan Limited purchased Building on credit from J. k. Builders Rs. 27,00,000 and issued 10% Debentures of Rs. 100 each as purchase consideration. pass Journal Entries from the following cases –

(a)If debentures issued at par.

(b)If debentures issued at 10% Discount.

(c)If debentures issued at 25% Premium.

ISC ACCOUNTS Sample paper 2023

Question 13 [3]

A, B and C were partners sharing profits in the ratio of 6:4:5. On 1st April, 2016, B retired from the firm and the new profit-sharing ratio between A and C was decided as 11:4. On B’s retirement, the goodwill of the firm valued at Rs.3,60,000. Pass journal entry for treatment of goodwill on B’s retirement

OR

The net profit of X, Y and Z for the year ended March 31, 2022was ₹3,00,000 and the same was distributed among them in their agreed ratio of 3:1:1. It was subsequently discovered that the under mentioned transactions were not recorded in the books:

(i) Interest on Capital @ 12% p.a.

(ii) Interest on drawings amounting to X ₹1,900, Y ₹1,600 and Z ₹1,500.

(iii) Partner’s Salary: X ₹2,000 pm. Y ₹36,000 p.a.

The capital accounts of partners were fixed as: X ₹1,00,000, Y ₹80,000 and Z ₹60,000. Record the adjustment entry.

Question 14 [3]

A and B sharing profits and losses in the ratio of 3:2 decide to admit C for 1/4rd share. On this date, their balance sheet disclosed the following items. Pass journal Entries in the Books of firm.

Investment fluctuation Reserve 80,000

Investment (at costs) in Balance sheet 4,00,000

Case (i) If the Market value of investment is Rs. 3,50,000

Case (ii) If the Market value of investment is Rs. 3,20,000

Case (iii) If the Market value of investment is Rs. 3,00,000

ISC ACCOUNTS Sample paper 2023

Question 15 [6]

The Balance Sheet of Ravi and Kavi as at 31st March, 2022, was as follows:

Balance Sheet of Ravi and Kavi As at 31st March, 2022

| Liabilities | (₹) | Assets | (₹) |

| Creditors

Investment Fluctuation Fund Capital Accounts: Ravi Kamal |

50,000 3,000

35,000 27,500

1,15,500 |

Cash

Debtors Stock Furniture Property Investment |

14,000 47,000 23,000 500 20,000 11,000

1,15,500 |

The partners shared profits in the ratio of 4:1. On that date Shubi is admitted into the partnership for 1/5 share of profit on the following terms:

- Shubi brings in ₹ 35,000 as capital and ₹15,000 as premium for goodwill in cash.

- The value of the stock is reduced by ₹3,000 while Property is appreciated by 20%.

- Furniture is revalued at ₹450.

- A provision for doubtful debts is to be created on sundry debtors at 10%

- Patents worth ₹ 5,000 (not mentioned in the balance sheet) is to be taken into account.

- Market value of investment ₹12,000. Prepare Revaluation account.

ISC ACCOUNTS Sample paper 2023

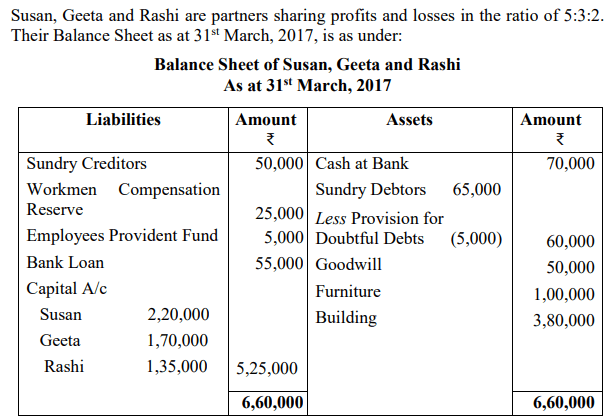

Question 16 [6]

The partners decided to dissolve their partnership on 31st March 2017.

The following transactions took place at the time of dissolution:

(a) Realization expenses of ₹ 2,000 were paid by Susan on behalf of the firm.

(b) Geeta took over the goodwill for her own business at ₹ 40,000.

(c) Building was taken over by Rashi at ₹ 3,00,000.

(d) Only 80% of the debtors paid their dues.

(e) Furniture was sold for ₹ 97,000.

(f) Bank Loan was settled along with interest of ₹ 5,000.

You are required to prepare the Realization Account. (ISC 2017)

OR

Harish, Paresh and Mahesh were three partners sharing profits and losses in the ratio of

5:4:1.

Paresh retired on 31st March, 2017. His capital as on 1st April, 2016, was ₹ 80,000.

During the year 2016-17, he made drawings of ₹ 5,000. He was to be charged interest on

drawings of ₹ 100.

The partnership deed provides that on the retirement of a partner, he will be entitled to:

(i) His share of capital.

(ii) Interest on capital @ 10% per annum.

(iii) His share of profit in the year of retirement.

(iv) His share of goodwill of the firm.

(v) His share in the profit/loss on revaluation of assets and liabilities.

Additional information:

(a) Paresh’s share in the profits of the firm for the year 2016-17 was ₹ 20,000.

(b) Goodwill of the firm was valued at ₹ 24,000.

(c) The firm suffered a loss of ₹ 12,000 on the revaluation of assets and liabilities.

(d) It was decided to transfer the amount due to Paresh to his loan account bearing

interest @ 6% per annum. The loan was to be repaid in two equal annual

instalments, the first instalment to be paid on 31st March, 2018.

You are required to prepare:

(i) Paresh’s Capital Account.

(ii) Paresh’s Loan Account till it is finally closed (ISC 2017)

Question 17 [6]

Jay and Vijay are partners in a firm sharing profits and losses in the ratio of 3 : 2. Sanjay is admitted as a new partner for 3/13th share in the profits. Sanjay contributed the following assets towards his capital and for his share of goodwill. Land ₹ 90,000; Machinery ₹ 90,000; Stock ₹ 60,000; Debtors ₹ 60,000. On the date of admission, Goodwill of the firm is valued at Rs. 5,20,000. Journalize the above transaction in the books of firm.

ISC ACCOUNTS Sample paper 2023

Question 18 [10]

Subhash Ltd. was registered with an authorized capital of ₹40,00,000 divided into 4,00,000

Equity Shares of ₹10 each.

The company offered 1,00,000 shares to the public at a premium of ₹2 per share, payable as

follows:

₹ 3 on application

₹ 6 on allotment (including premium)

₹ 3 on first and final call (due two months after allotment)

Applications were received for 1,20,000 shares and pro-rata allotment was made as follows:

Category A: The applicants of 80,000 shares were allotted 60,000 shares.

Category B: The applicants of 40,000 shares were allotted in full.

Excess money paid on application was utilized towards allotment.

Sunil, a shareholder from Category A, who had applied for 1,200 shares failed to pay the

allotment and call money.

Anil, a shareholder from Category B, who had been allotted 1,000 shares, paid the call

money due, along with allotment.

The company forfeited Sunil’s shares after the first and final call and paid interest on Callsin-advance to Anil @ 12% per annum on the day of the final call.

You are required to:

Pass journal entries to record the above transactions in the books of the company

(including entries for interest on Calls-in-advance).

OR

The partnership agreement of Rohit, Ali and Sneh provides that:

(i) Profits will be shared by them in the ratio of 2:2:1.

(ii) Interest on capital to be allowed at the rate of 6% per annum.

(iii) Interest on drawings to be charged at the rate of 3% per annum.

(iv) Ali to be given a salary of ₹ 500 per month.

(v) Ali’s guarantee to the firm that the firm would earn a net profit of at least ₹ 80,000 per annum and any shortfall in these profits would be personally met by him.

The capitals of the partners on 1st April, 2021, were:

Rohit – ₹ 1,20,000; Ali- ₹ 1,00,000; Sneh- ₹ 1,00,000.

All the three partners withdrew ₹1,000 each at the beginning of every month. The net profit for the year 2021-22 was ₹ 70,000.

You are required to prepare for the year 2021- 2022:

(i) Profit and Loss Appropriation Account.

(ii) Ali’s Capital Account.

ISC ACCOUNTS Sample paper 2023

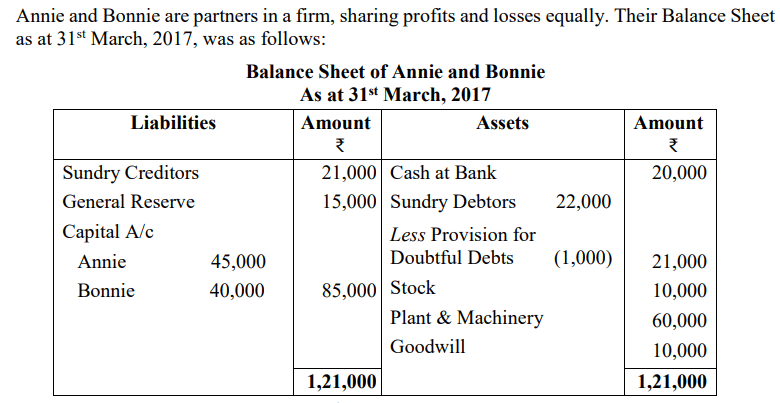

Question 19 [10]

Carl was to be taken as a partner for 1/4 share in the profits of the firm, with effect from

1st April, 2017, on the following terms:

(a) Bad debts amounting to ₹ 1,500 to be written off.

(b) Stock to be taken over by Annie at ₹ 12,000.

(c) Plant and Machinery to be valued at ₹ 50,000.

(d) Goodwill of the firm to be valued at ₹ 20,000.

(e) Carl to bring in ₹ 50,000 as his capital. He was unable to bring in cash, his share of

goodwill.

(f) General Reserve not to be distributed. For this, it was decided that Carl would

compensate the old partners through his current account.

You are required to:

(i) Pass journal entries on the date of Carl’s admission.

(ii) Prepare the Balance Sheet of the reconstituted firm.(ISC 2017)

OR

Naresh, Dhruv and Azeem are partners sharing profits in the ratio of 5:3:7. Naresh retires from the firm. Dhruv and Azeem decided to share profits in the ratio of 2:3. The adjusted capital accounts of Dhruv and Azeem at the time of Naresh’s retirement showed the balances of ₹ 33,000 and ₹ 70,500 respectively. The total amount to be paid to Naresh is ₹ 90,500 which is paid in cash immediately by the firm, the cash being contributed by Dhruv and Azeem in such a way that their capitals become proportionate to their new profit-sharing ratio and the firm maintains a minimum cash balance of ₹ 5,000 from its existing balance of ₹ 20,000.

You are required to pass journal entries to record:

• Payment made to the retiring partner

• Cash brought in by the remaining partners to pay off the retiring partner

ISC ACCOUNTS Sample paper 2023

SECTION B (20 Marks)

Answer all questions

Question 20 [1]

Which of the following transactions would not create a cash flow?

(a) A company purchased some of its own stock from a stockholder

(b) Amortization of a patent

(c) Payment of a Cash Dividend

(d) Sale of equipment at book value

Question 21 [1]

Net revenue from Operation: ₹30,00,000

Cost of Revenue from Operation: ₹24,00,000, Wages: ₹40,000, Salary: ₹40,000, Factory Expenses: ₹60,000, Office Management Expenses: ₹1,00,000. Gross profit Ratio will be:

(a) 20%

(b) 16.6%

(c) 10%

(d) None of these

Question 22 [1]

Current Ratio 4:1 and the Quick Ratio is 2:5:1. Inventories: ₹22,500. Amount of Current Asset will be:

(a) ₹60,000

(b) ₹82,500

(c) ₹90,000

(d) None of These

Question 23 [1]

Common Size Statements are prepared:

(a) In the form of Ratios

(b) In the form of Percentages

(c) In both of the Above

(d) None of the Above

Question 24 [1]

Interest received in cash on loans and advances results in cash inflow from ………… activity

(a)Financing

(b)Investing

(c)Operating

(d)None of the above

ISC ACCOUNTS Sample paper 2023

Question 25 [3]

From the following particulars of Aarti Ltd., you are required to prepare a Common-size Balance Sheet as at 31st March, 2022.

| Particulars | 31.03.2022 (₹) |

| Shareholder’s Funds

Non-Current Liabilities |

15,00,000

3,00,000 |

| Current Liabilities | 2,00,000 |

| Total Equity & Liabilities | 20,00,000 |

| Non-current Assets

Current Assets Total Assets |

14,00,000

6,00,000 20,00,000 |

Or

From the following information, prepare a Comparative Statement of Profit and Loss Bharat Ltd:

| Particulars | 31.03.2020

Rs. |

31.03.2019

Rs. |

| Revenue from Operations | 30,00,000 | 26,00,000 |

| Cost of Material consumed | 18,50,000 | 14,00,000 |

| Interest from Investments | 1,50,000 | 1,00,000 |

| Employee Benefit Expenses | 2,50,000 | 2,00,000 |

| Tax Rate | 40% | 40% |

ISC ACCOUNTS Sample paper 2023

Question 26 [6]

From the following information, calculate the following ratios (ISC 2020) :

(i) Debt to Total Assets Ratio

(ii) Proprietary Ratio

(iii) Inventory Turnover Ratio

Fixed Assets ₹14,00,000

Current Assets (including inventory of ₹ 2,00,000) ₹ 10,00,000

Shareholders’ Funds ₹14,40,000

Non- Current Liabilities (10% Long-term Bank Loan) ₹8,00,000

Current Liabilities ₹5,00,000

Revenue from Operations ₹15,00,000

Gross Profit ₹6,00,000 (ISC)

ISC ACCOUNTS Sample paper 2023

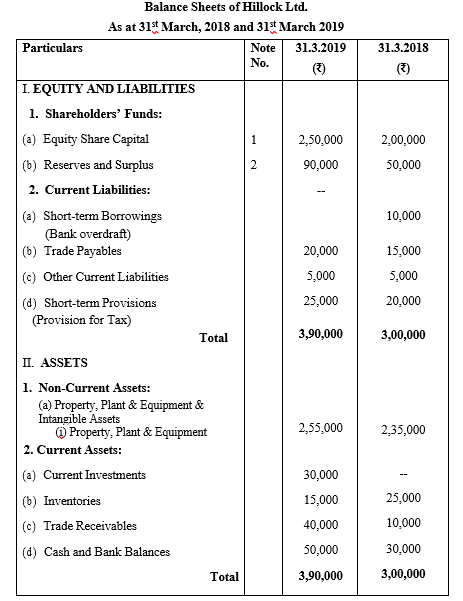

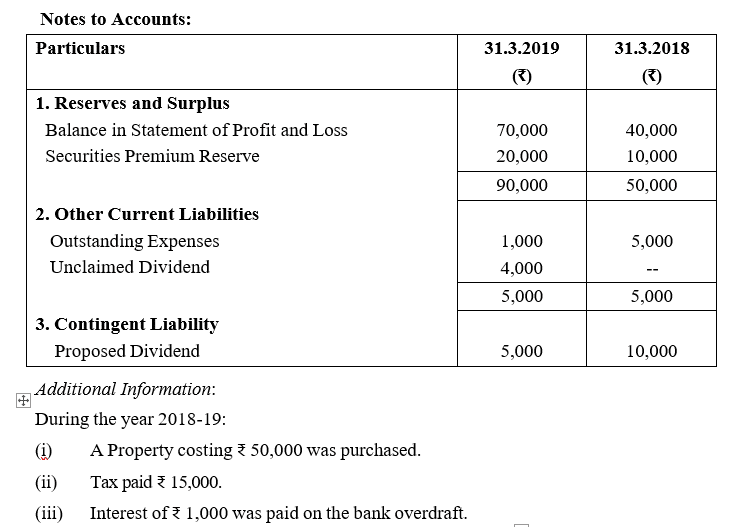

Question 27 [6]

You are required to prepare a Cash-Flow Statement (as per AS-3) for the year 2018- 19 from the following Balance Sheets: (ISC)

ISC ACCOUNTS Sample paper 2023

Admission of a partner-Important Questions-1

Important questions of fundamentals of partnership-3

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4

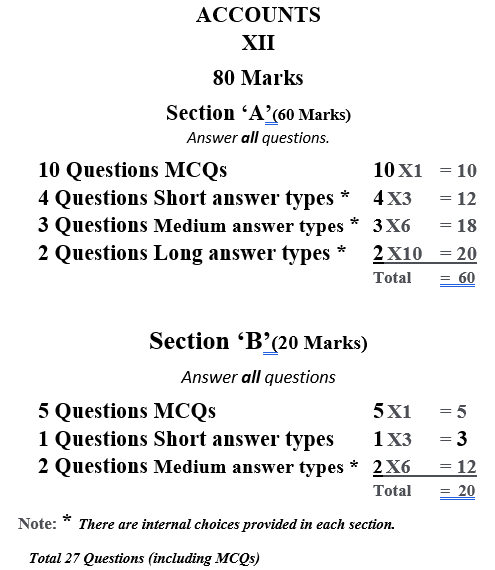

ISC New Exam. Pattern 2023 (ACCOUNTS)