Table of Contents

Cash Drawing Journal Entry

Drawing?

The money or goods or both withdrawn by the owner from the business for personal use is known as drawings. The amount of capital is reduced by the amount of drawings.

Or

Drawing is the amount of money or the value of goods which the proprietor takes away from

business for his/her household or private use.

* Drawing appears on the debit side of the trial balance.

* Drawing deduct from the capital on the liabilities side of the balance sheet.

* At the end of the financial year balance of the Drawing account is transferred to the capital account

* Interest is charged on drawing.

Examples of Drawing:

1. Purchase of Ornaments for wife by withdrawing money from the business.

2. Income Tax paid from the Business.

3. Life Insurance Premium Paid from the Business.

4. Household Expenses paid from the business.

5. Goods withdrawn for personal use from the Business.

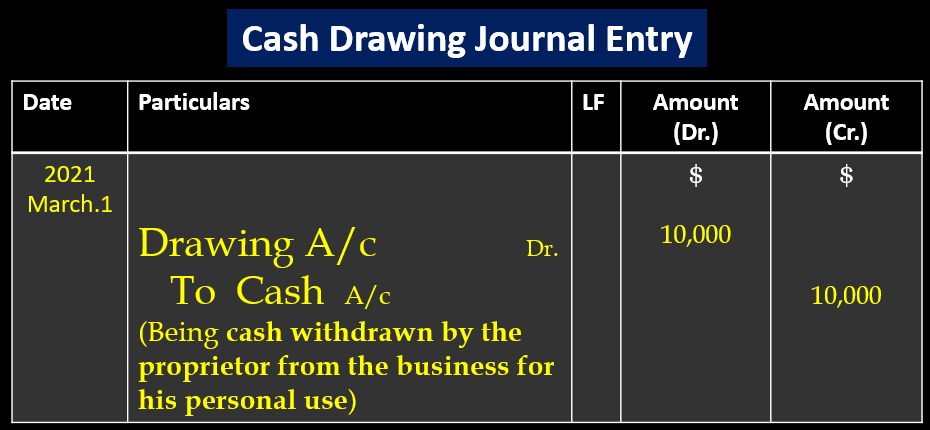

Cash Drawing Journal Entry

Example-

On 1st March 2021 Amount withdrawn by proprietors for his personal use $ 10,000 from the Business.Pass Journal Entry.

Explanation: According to the Modern approach in this transaction, Two accounts are affected-

1. Drawing account (Capital Account)

Rules of Capital Account– Increases in Capitals are credits; decreases in Capital are debits. Here Capital decreases in the form of Drawing (personal use by owner), so according to the rules (decreases in Capital are debits), the Drawing account will be debited $10,000 while passing the journal entry.

2. Cash account (Assets Account)

Rules of Assets Account– Increases in assets are debits; decreases in assets are credits.

Here the assets decrease in the form of cash, according to the rules,(decreases in assets are credits) cash account will be credited ₹10,000 while passing the journal entry.

Cash Drawing Journal Entry

The balance of the Drawing account is transferred to the capital account

At the End of the Financial year, the Balance of the Drawing account is transferred to the capital account. The following journal entry is passed in the journal:

Cash Withdrawal from Bank Journal Entry

Cash deposit into bank journal entry

Double Column Cash Book (Cash and Bank)

Outstanding Salary Journal Entry

Bad Debts Recovered Journal entry