Table of Contents

Credit Sales Journal Entry

Sales refer to the amount of goods sold that are already bought or manufactured by the business enterprise. When goods are sold for cash, they are cash sales but, if goods are sold and payment is not received at the time of sale, it is credit sales. Total sales include both cash and credit sales.

Total Sales= Cash sales+ credit sales

When goods are sold on credit, the journal entry is passed in the books of account in the following manner-

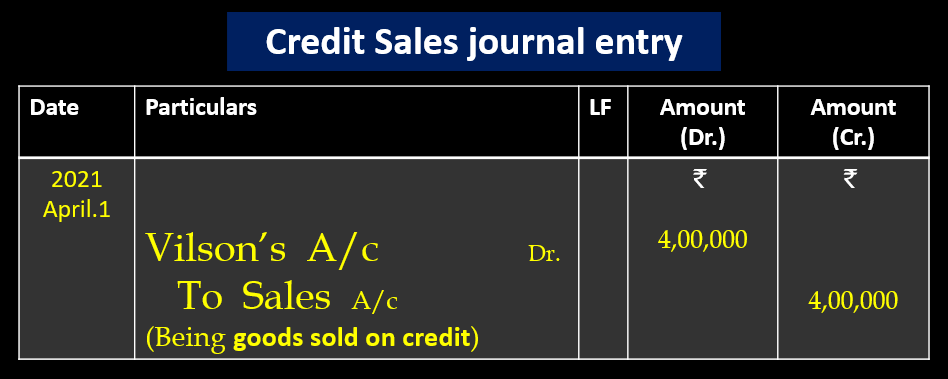

Goods sold on credit journal entry (According to Traditional Approach)

Example- On 1st April 2021 goods sold on credit to Vilson ₹4,00,000.

Explanation: According to the traditional approach in this transaction, two accounts are affected-

1. Vilson’s account (Personal Account)

Rules of Personal Account– Debit the receiver, credit the giver. Here Vilson is the receiver of the goods, so according to the rules(Debit the receiver), Vilson’s account will be debited while passing the journal entry.

2. Sales account (Nominal Account)

Rules of Nominal Account: Debit all losses and expenses, and credit all Income and gain.

Sales Account will be credited as per the rules (credit all Income and gain) at the time of passing the journal entry.

Credit sales journal entry (Traditional Approach)

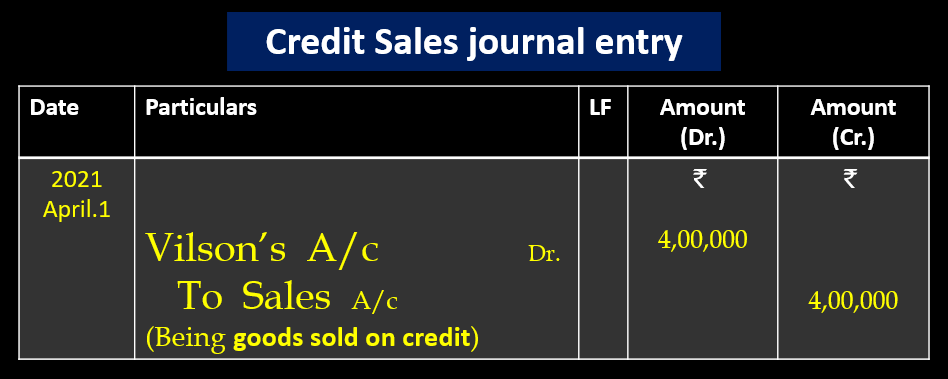

Goods sold on credit journal entry (According to Modern Approach)

Example- On 1st April 2021 goods sold on credit to Vilson ₹4,00,000.

Explanation: According to the modern approach in this transaction, two accounts are affected-

1. Vilson’s Account (Debtors Account) (Assets Account) –

Rules of Assets Account: Increases in assets are debits; decreases in assets are credits.)

Here the assets in the form of Debtors(Vilson) are increasing so according to the rules (Increases in assets are debits) Vilson’s account will be debited while passing the journal entry.

2. Sales Account (Revenue Account)

Rules Revenue Account: Increases in incomes and gains are credits; decreases in incomes and gains are debits.

The revenue is increasing in the form of sales here, so the Sales account will be credited as per rules(Increases in incomes and gains are credits) while passing the journal entry.

Credit sales journal entry (Modern Approach)

Cash Withdrawal from Bank Journal Entry

Cash deposit into bank journal entry

Double Column Cash Book (Cash and Bank)