ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 1.

Sudesh Ltd. was registered with an authorized capital of ₹40,00,000 divided into 4,00,000 Equity Shares of ₹10 each. The company offered 50,000 shares to the public at a premium of ₹2 per share,

payable as follows: ₹ 3 on application ₹ 6 on allotment (including premium) ₹ 3 on first and final call (due two months after allotment) Applications were received for 60,000 shares and pro-rata allotment was made as follows:

Category A: The applicants of 40,000 shares were allotted 30,000 shares.

Category B: The applicants of 20,000 shares were allotted in full.

Excess money paid on application was utilized towards allotment.

Nobby, a shareholder from Category A, who had applied for 1,200 shares failed to pay the allotment and call money. Vineet, a shareholder from Category B, who had been allotted 1,000 shares, paid the call money due, along with allotment.

The company forfeited Nobby’s shares after the first and final call and paid interest on Calls- in-advance to Vineet @ 12% per annum on the day of the final call.

You are required to:

(i) Pass journal entries to record the above transactions in the books of the company (including entries for interest on Calls-in-advance).

(ii) Prepare Calls-in-arrears Account.

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 2.

Anita and Tony, each doing business as sole proprietors, started a partnership on 1st April 2018. Anita brought in Plant and Machinery valued at ₹5,00,000 whereas Tony brought in furniture costing ₹50,000 and ₹7,00,000 in cash.

Since the business needed more funds, Tony gave a loan of ₹2,00,000 to the firm on 30th June, 2018.

Their partnership deed provided for:

(a) Interest on capital to be allowed @10% per annum.

(b) Interest on drawings to be charged @ 6% per annum.

(c) Anita to be given a commission of 4% on the corrected net profits before charging commission.

(d) Tony to be given a salary of ₹12,000 per annum.

Tony withdrew ₹5,000 at the end of every month and Anita withdrew ₹30,000 on 1st August,2018.

The net profit of the firm, for the year 2018-19, after debiting Tony’s salary of ₹12,000 per annum but before considering any interest due to and due from the partners, was ₹4,00,000.

You are required to prepare for the year 2018-19:

(i) Profit and Loss Appropriation Account.

(ii) Partners’ Capital Accounts.

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 3.

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3:1. On 1st April, 2017, they admit Chanda into their partnership with 1/5th share in the profits.

Chanda brings in ₹ 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm.

At the time of Chanda’s admission:

(a) The firm had a Workman Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

You are required to, on the date of Chanda’s admission:

(i) Calculate the goodwill of the firm. (Show the workings clearly).

(ii) Pass the necessary journal entries to record the above transactions.

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 4.

You are required to pass journal entries to record the following issues of debentures and to write off any capital losses.

- Zoom Ltd. issues 6,000, 12% Debentures of ₹ 100 each at par redeemable after 5 years also at par.

- Zola Ltd. issues 5,000, 13% Debentures of ₹ 100 each at a discount of 10% to be redeemed at par after 7 years.

- Zubic Ltd issues 11% Debentures of the total face value of ₹ 12,00,000 at a premium of 5% to be redeemed at par after 6 years.

- Ruby Ltd. issues ₹ 5,00,000, 12% Debentures at a premium of 5% to be redeemed at 10% premium after 10 years.

- Emerald Ltd. issues 3,000, 9% Debentures of ₹ 100 each at a discount of 7%, to be redeemed at a premium of 10% after 4 years.

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 5.

1.Calculate the Gross Profit Ratio from the following information:

Particulars

Opening Inventory ₹ 80,000

Closing Inventory ₹ 1,00,000

Revenue from Operations ₹ 9,00,000

Inventory Turnover Ratio 8 times

2. From the following information, calculate the following ratios (up to two decimal places):

(i) Debt to Total Assets Ratio

(ii) Proprietary Ratio

(iii) Inventory Turnover Ratio

Particulars

(₹) Fixed Assets (₹) 14,00,000

Current Assets (including inventory of ₹ 2,00,000) ₹ 10,00,000

Shareholders’ Funds (₹) 14,40,000

Non-Current Liabilities (10% Long-term Bank Loan) (₹) 8,00,000

Current Liabilities (₹) 5,00,000

Revenue from Operations (₹) 15,00,000

Gross Profit (₹) 6,00,000

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 6.

From the following data, prepare a Common Size Balance Sheet of Palms Ltd. as at 31st March, 2018: (All calculations up to two decimal places)

Particulars 31.03.2018 ₹

Share Capital 24,00,000

Trade Payables 2,40,000

Fixed Assets (Tangible) 20,00,000

Fixed Assets (Intangible) 2,00,000

Reserves and Surplus 3,60,000

Cash and Bank Balances 8,00,000

Short-term Loans and Advances 2,00,000

Short-term Borrowings 40,000

Long-term Borrowings 1,60,000

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 7.

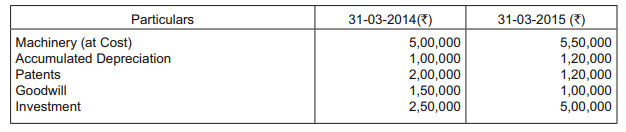

From the following information calculate cash flow from investing activities:

Additional Information:

- During the year, a machine costing ₹50,000 with its accumulated depreciation of ₹25,000 was sold for ₹20,000.

- Patents were written off to the extent of ₹ 60,000 and some patents were sold at a profit of ₹10,000.

- 40% of the investments held in the beginning of the year were sold at 10% Profit.

- Interest received on investment ₹25,500

- Dividend received on investment ₹8,500.

- Rent received ₹5,000.

Question 8.

On April 1, 2018, a firm has assets of ₹1,00,000 excluding stock of ₹20,000 . The current liabilities were ₹ 10,000 and the balance constituted partner’s capital Accounts. If the normal rate of return is 8 %, the Goodwill of the firm is valued at ₹ 60.000 at four years purchase of super profit, find the actual profits of the firm.

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Question 9.

The profits for the last five years of a firm were as follows –

year 2013-14 ₹ 1,92,000;(Including Abnormal Gain ₹ 15,000 on profit on the sale of fixed assets)

year 2014-15 ₹ 95,000; (After debiting Loss of stock by fire ₹75,000)

year 2015-16 ₹ 1,23,000;(Including interest on Non-trade Investment ₹ 10,000)

year 2016-17 ₹ 1,30,000. (Closing Stock overvalued by 10,000 at the end of the financial year 2017)

Calculate the value of goodwill of the firm on the basis of 2 years purchase of average profit for the last four years.

Admission of a partner-Important Questions-1

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Important questions of fundamentals of partnership-3

Question 10.

A, B, and C are partners sharing profits in the ratio of 3:2:1 . A dies on 31st July 2022. The profits of the firm for the year ending 31st March 2022, were 84,000.

What will be A’s share of profit until his death, When profit is calculated On the basis of Last year’s Sales of ₹4,20,000 and Current year sales up to 31st July are ₹1,80,000.

Format of Profit and loss Appropriation Account

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Hidden Goodwill at the time of Admission of A New Partner

Question 11.

Karan and Vijay are partners in a firm sharing profits and losses in the ratio of 4:3. They admit Shrey for 𝟏 𝟑 ⁄ share in the profits. On the date of Shrey’s admission:

(a) The capitals of Karan and Vijay are: ₹ 40,000 and ₹ 30,000 respectively.

(b) Profit and Loss Account has a debit balance of ₹ 7,000.

(c) General Reserve shows a balance of ₹ 21,000 which is not to be disturbed.

(d) Goodwill of the firm is valued at ₹ 42,000.

(e) The cash at bank is ₹ 15,000.

(f) Shrey brings in proportionate capital and his share of goodwill in cash.

You are required to prepare:

(i) Partners’ Capital Accounts.

(ii) Cash at Bank Account of the reconstituted firm on the date of Shrey’s admission.

Important questions of fundamentals of partnership

Question 12.

Determine Return on Investment from the following information:-

Net Profits after Tax were ₹ 6,00,000; Tax rate was 40%; 15% Debentures were of ₹20,00,000; 10% Bank Loan was ₹ 20,00,000; 12% Preference Share Capital ₹ 30,00,000; Equity Share Capital ₹ 40,00,000 ; Reserves and Surplus were ₹ 10,00,000;

Important questions of fundamentals of partnership-2

Question 13.

Classify the following items under Major heads and Sub-head (if any) in the Balance Sheet of a Company as per schedule III of the Companies Act 2013.

(i) Current maturities of long-term debts

(ii) Furniture and Fixtures

(iii)Provision for Warranties

(iv)Income received in advance

(v) Capital Advances

(vi)Advances recoverable in cash within the operation cycle

Goodwill questions for practice Class 12 ISC & CBSE

Question 14.

Q retired on the above-mentioned date on the following terms:

(i) Buildings to be appreciated by ₹7,000

(ii) A provision for doubtful debts to be made at 5 % on debtors.

(iii)Goodwill of the firm is valued at ₹ 18,000

(iv)₹ 2,800 was to be paid to Q immediately and the balance in his capital account to be transferred to his loan account carrying interest as per the agreement.

(v) Remaining partner decided to maintain equal capital balances, by opening current account.

Important questions of fundamentals of partnership-5

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Question 15.

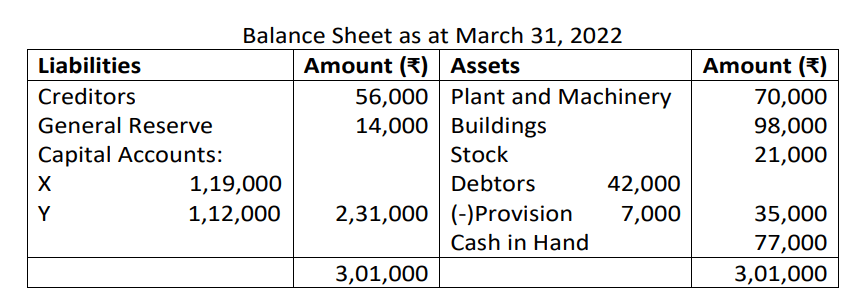

X and Y were partners in the profit-sharing ratio of 3: 2. Their balance sheet as at March 31, 2022 was as follows:

Z was admitted for 1/6th share on the following terms:

(i) Z will bring ₹ 56,000 as his share of capital, but was not able to bring any

amount to compensate the sacrificing partners.

(ii) Goodwill of the firm is valued at ₹. 84,000.

(iii)Plant and Machinery were found to be undervalued by ₹ 14,000 Building was to brought up to ₹ 1,09,000.

(iv)All debtors are good.

(v) Capitals of X and Y will be adjusted on the basis of Z’s share and adjustments will be done by opening necessary current accounts.

You are required to prepare revaluation account and partners’ capital account.

Admission of a partner-Important Questions-3

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4

ISC ACCOUNTS CLASS 12 QUESTIONS FOR PRACTICE