Table of Contents

ISC Accounts Sample paper 2023-2

ISC ACCOUNTS Sample paper 2023-2

ISC ACCOUNTS Sample paper 2023-2

ACCOUNTS

Class-XII

Maximum Marks: 80

Time Allowed: Three hours

There are internal choices provided in each section.

The intended marks for questions or parts of questions are given in the brackets [].

All calculations should be shown clearly.

All working, including rough work, should be done on the same page as, and

adjacent to, the rest of the answer.

SECTION A (60 Marks)

Answer all questions.

Question 1 [1]

Ram, Shyam and Mohan are partners in a firm. Their profit sharing ratio is 5 : 3 : 2. However, Mohan is guaranteed a minimum amount of ₹ 60,000 as share of profit every year. Any deficiency arising on that amount shall be met by Ram and Shyam equally. The profits for the years ended 31st March 2022 ₹ 2,50,000. What will be the profit of ram’s share?

(a) ₹1,25,000

(b) ₹1,20,000

(c) ₹1,30,000

(d) ₹ 60,000

Question 2 [1]

In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of ….

(A) 6%

(B) 6% p.a.

(C) 12%

(D) None of these

Question 3 [1]

Ajay and Vijay are partners with the capital of Rs. 25,000 and Rs.15,000 respectively. Interest payable on capital is 10% p.a. Find the interest on capital for both the partners when the profits earned by the firms isRs. 2, 400 before interest on capital.

(A) Rs. 2,500 and 1,500

(B) Rs.1,500 and 900

(C) Rs.1,200 and 1,200

(D) None of these

ISC ACCOUNTS Sample paper 2023-2

Question 4 [1]

Partnership Deed is also called…..

(A) Prospectus

(B) Articles of Association

(C) Principles of Partnership

(D) Articles of Partnership

Question 5 [1]

The profit for the last five years of a firm was as follows:

Year 2012₹ 1,10,000 (Abnormal Income Included ₹10,000)

Year 2013 ₹ 1,50,000

Year 2014 ₹ 1,80,000 (Abnormal Loss ₹20,000)

Year 2015 ₹ 2,80,000

Year 2016 ₹2,90,000 (Closing Stock Overvalued ₹20,000)

(i) The average profits for the last five years will be:

(a) ₹ 10,00,000

(b) ₹ 2,40,000

(c) ₹ 3,33,333

(d) ₹ 2,00,000

ISC ACCOUNTS Sample paper 2023-2

Question 6 [1]

Name the asset that is not transferred to the debit side of the Realisation Account, but brings certain amount of cash against its disposal at the time of dissolution of the firm.

(a) Building

(b) Machinery

(c) Goodwill

(d) Unrecorded asset

Question 7 [1]

RACHIT COMPANY Ltd issued for public subscription 40,000 equity shares of ₹ 10 each. Application received for 50,000 shares. 40,000 shares allotted to 50,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. The amount payable as under:

On application ₹ 2 per share,

on allotment ₹ 5 per share,

on first and Final call ₹ 3 per share.

A shareholder who applied for 1,000 shares failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were reissued at ₹12 per share fully paid up

At the time of forfeiture of shares, the Share Capital A/c was debited with:

(a) ₹ 8,000

(b) ₹ 10,000

(c) ₹ 12,000

(d) ₹ 7,000

Question 8 [1]

A, B and C were partners sharing profits in the ratio of 6:4:5. On 1st April, 2022, B retired from the firm and the new profit sharing ratio between A and C was decided as 11:4. On B’s retirement, the goodwill of the firm valued at ₹90,000. Journal entry for treatment of goodwill on B’s retirement?

Question 9 [1]

At the time of dissolution of partnership firm, Book value of stock ₹15,000. Y took over part of stock at ₹4,000 (being 20% less than the book value). Balance stock realised 80%. what will be the anount realised from stock?

(a) ₹8,000

(b) ₹8,800

(c) ₹11,600

(d) ₹12,000

Question 10 [1]

A balance sheet of a Company is prepared as per the format prescribed in…

(a) Part II of Schedule III of the Companies Act, 2013

(b) Part I of Schedule III of the Companies Act, 2013

(c) Part III of Schedule III of the Companies Act, 2013

(d) None of these

ISC ACCOUNTS Sample paper 2023-2

ISC ACCOUNTS Sample paper 2023

Question 11 [3]

The capital accounts of Jay, Vijay, and Sanjay show the balance after all the adjustments and revaluation as ₹1, 82,000, ₹178,000, and ₹140,000 respectively. They admit Ajay as a new partner for 1/5 share in the profits. Ajay brings proportionate capital in cash. Calculate Ajay’s share of capital.

OR

The profits for the last five years of a firm were as follows –

Year 2012-13 ₹ 2,20,000;

year 2013-14 ₹ 1,85,000;(Including Abnormal Gain ₹ 35,000)

year 2014-15 ₹ 95,000; (After debiting Loss of stock by fire ₹55,000)

year 2015-16 ₹ 1,20,000;

year 2016-17 ₹ 1,30,000.

Calculate the goodwill of the firm on the basis of 3 years purchases of the weighted average profit of the last 5 years. The weights assigned to each year are:

2012-13: 1

2013-14: 2

2014-15 : 3

2015-16: 4

2016-17: 5

ISC ACCOUNTS Sample paper 2023-2

Question 12 [3]

On 31st March, 2021, the books of Jay Ltd. (an unlisted manufacturing company) showed

the following closing balances:

7% Debentures (redeemable on 30th September, 2022) ₹ 30,00,000

Debenture Redemption Reserve ₹ 1,00,000

In order to meet the provisions of the Companies Act, 2013, the company transferred the

required balance amount to Debenture Redemption Reserve Account on 31st March, 2022.

It met the requirements of Debenture Redemption Investment.

You are required to prepare the Debenture Redemption Reserve Account for the years

2021-22, 2022-23.

Or

Mohit Ltd. (an unlisted company ) has 20,000, 8 % Debentures of 100 each due for redemption on 31st March 2022.

Debenture Redemption Reserve has a balance of ₹80,000 on 31st March, 2021. It was decided to invest the required amount towards Debenture Redemption Investment.

Investments were realised at 104 % less 0.5 % brokerage and debentures were redeemed. Record the necessary entries for the redemption of debentures.

Question 13 [3]

Pass Journal entries for the following transactions in the book of the firm on its dissolution:

A) Bills receivable of ₹50000 discounted with the bank is dishonoured as drawee was declared insolvent and 40% amount is received in cash from him.

b) 100 shares of Bajaj Auto Ltd. acquired at a cost ₹ 3,600 had been written of from the books. These were valued at ₹ 120 par share, and were divided among partner’s A and B in 2 : 1.

c) Mr. Verma, a creditor to whom Rs. 6,000 are due, accepted office equipment

at ₹ 4,000 and the balance paid to him by cash

Question 14 [3]

Pass the necessary journal entries on the dissolution of a firm in the following cases:

(a) Dharama, a partner, was appointed to look after the process of dissolution at a remuneration of ₹ 12,000 and he had to bear the dissolution expenses. Dissolution expenses ₹11,000 were part by the Bharma.

(b) Jay a partner was to look after the process of dissolution and for this work he was allowed a remuneration of ₹ 7,000 agreed to bear all dissolution expenses. Actual expenses ₹ 6000 were pound from firm’s Bank A/c.

(c) Realisation expenses ₹12000 born by the partner Deepa. These expenses were

paid by Deepa by drawing cash from the firm. She was allowed commission

₹ 10,000 for process of dissolution.

ISC ACCOUNTS Sample paper 2023-2

Question 15 [6]

BHARAT COMPANY limited issued 5,000, 12% debentures of ₹ 100 each on 1st April,2021 at par redeemable at a premium of 5%. Interest on these debentures is paid half yearly, i.e., on 30th September and 31st March. Pass necessary journal entries for the year ended 31st March, 2022 assuming income tax is deducted @ 20% on the amount of interest.

ISC ACCOUNTS Sample paper 2023-2

Question 16 [6]

Kapil Rajesh and Suresh set up a partnership firm on April 1 2021. They contributed ₹ 5,00,000, ₹ 4, 00,000 and ₹3, 000,00, respectively as their capitals and agreed to share profits and losses in the ratio of 5: 3: 2. Kapil is to be paid a salary of ₹ 10,000 per month and Rajesh, a Commission of ₹ 50,000. It is also provided that interest to be allowed on capital at 6% p.a.The drawings for the year were Kapil ₹60,000, Rajesh ₹ 40,000 and Suresh ₹ 20,000. Interest on drawings

of ₹ 2700 was charged on Kapil’s drawings, ₹ 1800 on Rajesh’s drawings and ₹ 900 on Suresh’s drawings. The net profit as per Profit and Loss Account for the year ending March 31, 2022 was ₹ 3, 56600. Prepare the Profit and Loss Appropriation Account to show the distribution of profit among the partners.

OR

A ,B and C are partners in a firm .capital accounts on 1 april 2021 stood at ₹ 2,00,000 , ₹1,00,000 and ₹ 1,00,000. Each partners withdrew ₹10,000 during the FY 2021-2022.

As per the provisions of the Partnership deed-

- B was entitled to a salary of ₹ 2,000 p.m.

- Int. on capital was to be allowed @ 10 % p.a.

- Int. on drawings was to be charged @ 4% p.a.

- Profits and losses were to be shared in the ratio of their capitals.

- C was entitled to a Commission ₹10,000

The net profit of ₹1,50,000 for the year ended 31st march 2022 was divided equally amongst the partners without providing for the terms of the Partnership deed. Pass single adjustment entry.

Question 17 [6]

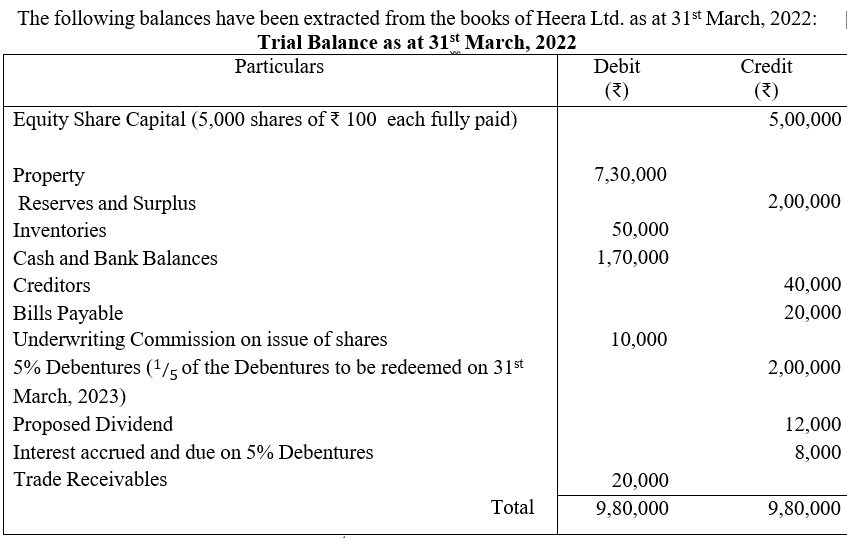

You are required to prepare as at 31st March, 2022:

- The Balance Sheet of Vanity as per Schedule III of the Companies Act, 2013.

- Notes to accounts

ISC ACCOUNTS Sample paper 2023-2

Question 18 [10]

Sarita Ltd. was registered with an authorized capital of ₹ 12,00,000, divided into 1,20,000 equity shares of ₹ 10 each. It issued 50,000 equity shares to the public at a premium of ₹ 5 per share, payable as follows:

On application ₹ 6

On allotment ₹ 9 (including premium of ₹ 5)

All the shares were applied for and allotted. One shareholder holding 1500 shares did not pay the allotment money and his shares were forfeited. Out of the forfeited shares, the company reissued 1200 shares at ₹ 7 per share fully called up.

You are required to:

- Pass journal entries in the books of the company.

- Prepare:

- Securities Premium Reserve

- Share Capital

OR

Arham Ltd. issued 40,000 shares of ₹ 10 each at a premium of ₹2 payable ₹5 on application including premium, ₹4 on allotment and ₹ 3 on call.

The company received applications for 55,000 shares and allotment was made as under:

(i) Applicants for 20,000 shares were allotted in full.

(ii) Applicants for 25,000 shares were allotted 20,000 shares.

(iii) Applicants for the rest shares were allotted Nil shares.

Mr. P who was allotted 200 shares under category (i) paid the full amount due on allotment.

Mr. Q holding 500 shares failed to pay call money. His shares were forfeited and reissued @ ₹ 8 per share fully paid. Pass journal entries in the books of the company.

ISC ACCOUNTS Sample paper 2023-2

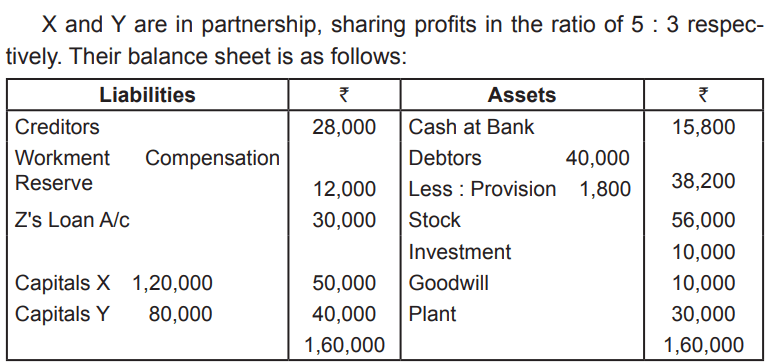

Question 19 [10]

Z is admitted into partnership on the following terms:

1. The new profit-sharing ratio will be 4 : 3: 2 between X, Y and Z respectively.

2. Z’s loan should be treated as his capital.

3. Goodwill of the firm is valued at ₹27,000.

4. ₹ 8,000 of investments were to be taken over by X and Y in their profit sharing ratio.

5. Stock be reduced by 10%.

6. Provision for doubtful debts should be @ 5% on debtors and a provision for discount on debtors @ 2% should also be made.

7. The liability of Workmen’s Compensation Reserve was determined to be ₹15,000.

8. X is to withdraw ₹ 6,000 in cash.

Prepare Revaluation Account, Partners Capital account and Balance sheet of the new firm.

OR

Harish, Paresh and Mahesh were three partners sharing profits and losses in the ratio of 5:4:1. Paresh retired on 31st March, 2022. His capital as on 1st April, 2021, was ₹ 90,000. During the year 2021-22, he made drawings of ₹ 10,000. He was to be charged interest on drawings of ₹ 1,000.

The partnership deed provides that on the retirement of a partner, he will be entitled to:

- His share of Capital

- Interest on capital @ 10% p.A.

- His share of profit in the year of retirement.

- His share of goodwill of the firm.

- His share in the profit/loss on revaluation of assets and liabilities.

Additional information:

- Paresh’s share in the profits of the firm for the year 2021-22 was ₹ 30,000.

- Goodwill of the firm was valued at ₹ 48,000.

- The firm suffered a loss of ₹ 15,000 on the revaluation of assets and liabilities.

- It was decided to transfer the amount due to Paresh to his loan account bearing interest @ 10% per annum. The loan was to be repaid in two equal annual instalments, the first instalment to be paid on 31st March, 2023.

You are required to prepare:

- Paresh’s Capital

- Paresh’s Loan Account till it is finally

ISC ACCOUNTS Sample paper 2023-2

ISC ACCOUNTS Sample paper 2023-2

SECTION B (20 Marks)

Answer all questions

Question 20 [1]

Working Capital Turnover Ratio explains the relationship between:

(a) Revenue from Operations and Working Capital

(b) Net credit purchase and Working Capital

(c) Credit Revenue from Operations and Working Capital

(d) Revenue from Operations and Total Capital

Question 21 [1]

Total Assets- 16,00,000

Fixed Assets- 10,80,000

Non Current Investment- 2,20,000

Shareholders funds- 12,00,000

Non-Current Liabilities- 1,60,000

Current Ratio-

(a) 300000/240000

(b) 520000/240000

(c) 520000/400000

(d) None of these

Question 22 [1]

What is Gross Profit + Cost of Materials consumed?

Question 23 [1]

How is interest paid on debentures considered in a Cash Flow Statement?

(i) As an Operating Activity

(ii) As a Financing Activity

(iii) As an Investing Activity

(iv) Both as an Operating Activity and a Financing Activity

Question 24 [1]

State the objective of calculating Debt Equity Ratio.

ISC ACCOUNTS Sample paper 2023-2

Question 25 [3]

From the following information, prepare a Common Size Statement of Profit and Loss of JK Ltd. for the year ending 31st March, 2022:

Particulars 31.03.2022

Revenue from Operations ₹ 25,00,000

Purchases ₹15,00,000

Changes in inventories ₹ 2,00,000

Other Income (Dividend received) ₹ 1,40,000

Depreciation and Amortization expenses ₹1,60,000

Tax Rate @ 40%

Question 26 [6]

From the following information calculate the following ratios (up to two decimal places): (ISC)

1. Earning per share

2. Return on Investments

3. Working Capital Turnover Ratio

Particulars ₹

Net profit after interest and tax 2,40,000

Tax 1,60,000

Net Fixed Assets 10,00,000

Non-current Investments (Non-Trade) 1,00,000

Equity Share Capital (face value ₹ 10 per share) 5,00,000

15% Preference Share Capital 1,00,000

Reserves and Surplus (including surplus of the year under consideration)

2,00,000

10% Debentures 4,00,000

Revenue from Operations 10,00,000

Working Capital 1,00,000

Note: The market value of an equity share is ₹ 40.

ISC ACCOUNTS Sample paper 2023-2

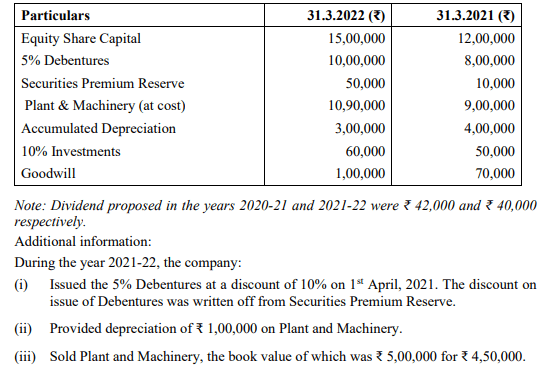

Question 27 [6]

From the following extracts of a company’s Balance Sheets, you are required to

calculate:(ISC sample paper)

(i) Cash from Investing Activities.

(ii) Cash from Financing Activities

Admission of a partner-Important Questions-1

Important questions of fundamentals of partnership-3

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4

ISC ACCOUNTS Sample paper 2023-2

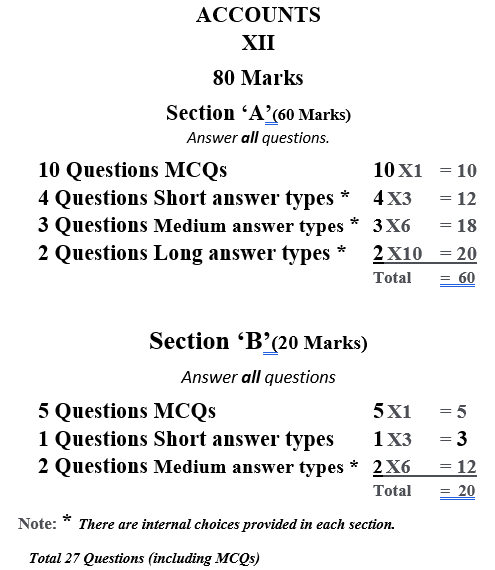

ISC New Exam. Pattern 2023