Table of Contents

ISC Accounts Sample paper 2023-3

ISC ACCOUNTS Sample paper 2023–3

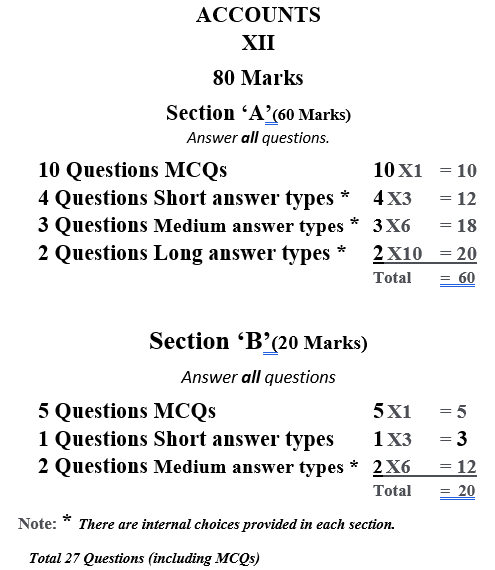

ACCOUNTS

Class-XII

Maximum Marks: 80

Time Allowed: Three hours

There are internal choices provided in each section.

The intended marks for questions or parts of questions are given in the brackets [].

All calculations should be shown clearly.

All working, including rough work, should be done on the same page as, and

adjacent to, the rest of the answer.

SECTION A (60 Marks)

Answer all questions.

Question 1 [1]

Which of the following item is not recorded in the Profit & Loss Appropriation Account of a partnership firm?

(A) Interest on Capital

(B) Salary to Partner

(C) Interest on Partner’s Loan

(d) Commission to partners

Question 2 [1]

………. is the excess of actual profit over the normal profit.

Question 3 [1]

Which of the following is not true in relation to Goodwill…..

(a) It is an Intangible Asset

(b) It is a Factious Asset

(c) It has a realisable value

(d) All of these

ISC ACCOUNTS Sample paper 2023-3

Question 4 [1]

In the absence of an agreement, partners are entitled to ——

(A) Salary

(B) Profit share in capital ratio

(C) Interest an loan and advances @ 6% p.a.

(D) Commission and Bonus

Question 5 [1]

Profit and Loss Appropriation Account is prepared to —-

(A) Create Reserve Fund

(B) Find out the Net Profit

(C) Find out Divisible Profit

(D) None of these

ISC ACCOUNTS Sample paper 2023-3

Question 6 [1]

At the time of dissolution of the Partnership firm, fictitious, assets are transferred to:-

(A) Capital Account of Partners

(B) Realisation Account

(C) Cash Account

(D) Partner’s Loan Account

Question 7 [1]

Jay and Vijay are partners sharing profits in the ratio of 2 : 3. Their balance sheet shows machinery at ₹ 4,00,000; stock at ₹ 1,60,000 and Debtors at ₹ 3,20,000. Sanjay is admitted and new profit sharing ratio is agreed at 6 : 9 : 5. Machinery is revalued at ₹3,40,000 and a provision is made for doubtful debts @ 2.5%. Jay’s share in loss on revaluation amount to ₹ 20,000. Revalued value of stock will be–

(a) ₹1,78,000

(b) ₹ 1,48,000

(c) ₹ 2,08,000

(d) ₹1,42,000

Question 8 [1]

A, B and C were partners in a firm sharing profits and losses in the ratio of 2:2:1 respectively with the capital balance of ₹60,000 for A ,₹ 60,000 for B, ₹ 40,000 for C. B declared to retire from the firm and balance in reserve on the date was ₹15,000. If goodwill of the firm was valued as ₹ 30,000 and profit on revaluation was ₹ 10,050 then what amount will be transferred to the loan account of C?

(a) Rs. 82,020.

(b) Rs. 50,820.

(c) Rs. 25,820.

(d) Rs. 58,820.

Question 9 [1]

Fill in the blanks:

Loose tools will be covered under main head ………………………….. and subhead …………………………..

Question 10 [1]

Premium on issue of shares can be used for …………….

(a) Distribution of dividend

(b) Writing of capital losses

(c) Transferring to general reserve

(d) Paying fees to Promoters

ISC ACCOUNTS Sample paper 2023-3

ISC ACCOUNTS Sample paper 2023

Question 11 [3]

P,Q and R are partner sharing profits in the ration of 3:2:1 . P dies on 31st July 2022. The profits of the firm for the year ending 31st March 2022, were ₹84,000.

Calculate P’s share of profit :-

A). On time Basis from 1 April to 31st July 2022 on the basis of Last year’s Profit

(B). On sales Basis Sales for the last year ₹ 4,20,000 and for the current year up to 31st July are₹ 1,80,000?

OR

Assets of the firms are ₹6,50,000 (excluding goodwill) and Liabilities are ₹1,50,000. The profits for the last three years were:

March 31 2019– ₹58,000:

March 31 2018- ₹ 72,000;

March 31 2017- ₹ 80,000;

Normal rate of return is 10%. You are required to find out the value of goodwill On the basis of capitalization of Average profit.

ISC ACCOUNTS Sample paper 2023-3

Question 12 [3]

Sarita Ltd. ( an unlisted company ) issued 20,000 12% Debentures of ₹ 100 each at a premium of 10 % on 1st April, 2015 redeemable on March 31 , 2021. The issue was fully subscribed. It was decided to invest 15 % of the face value of debentures to be redeemed towards Debenture Redemption Investment on 30th April , 2020 Investments were encashed and Debentures were redeemed on due date. Record necessary entries for redemption of debentures.

Or

JKB Ltd. raised a secured loan of ₹12,00,000 from State Bank of India and issued 1,600 10% debentures of ₹1,000 each as collateral security. Give the treatment of issue of such debentures

in the books of the company.

Question 13 [3]

Under which major heads and sub-heads the following items will be places in the Balance

Sheet of a company as per revised Schedule III, Part I of the Companies Act, 2013?

(i) Accrued Incomes

(ii) Loose Tools

(iii) Provision for Employees Benefits

Question 14 [3]

ONKAR Ltd. was formed on 1st April, 2020, with an authorized capital of ₹15,00,000 divided into Equity Shares of ₹ 10 each. It issued a prospectus inviting applications for 40,000 shares to be issued at par. The issue was fully subscribed and the amount due on the shares was received by the company.

On 1st April, 2021, the company issued another 60,000 shares at a premium of ₹2 per share to be received with allotment. Applications for 55,000 shares were received which were duly allotted.

All the amounts due on these shares were received except the final call of ₹2 per share on 1,000 shares.

You are required to show the relevant items under:

(i) Equity and Liabilities in the Balance Sheet of the Company as at 31st March, 2022 (prepared as per Schedule III of the Companies Act, 2013).

(ii) Notes to Accounts.

ISC ACCOUNTS Sample paper 2023-3

Question 15 [6]

Anita and Sunita, each doing business as sole proprietors, started a partnership on 1stApril, 2021. Anita brought in Plant and Machinery valued at ₹5,00,000 whereas Sunita brought in furniture costing ₹1,00,000 and ₹6,00,000 in cash. Since the business needed more funds, Sunita gave a loan of ₹2,00,000 to the firm on 1st July, 2021.

Their partnership deed provided for:

(a) Interest on capital to be allowed @10% per annum.

(b) Interest on drawings to be charged @ 6% per annum.

(c) Anita to be given a commission of 4% on the corrected net profits before charging commission. (d) Sunita to be given a salary of ₹12,000 per annum.

Sunita withdrew ₹5,000 at the end of every month and Anita withdrew ₹30,000 on 1st August, 2021.

The net profit of the firm, for the year 2021-22, after debiting Sunita’s salary of ₹12,000 per annum but before considering any interest due to and due from the partners, was ₹3,88,000. You are required to prepare Profit and Loss Appropriation Account.

Or

Ram and Ramesh were partners in a firm sharing profits in the ratio of 3 : 2. Their respective capitals were Ram ₹8,50,000 and Ramesh ₹6,50,000 On 1st April 2021.

During the year their drawings were ₹ 30,000, ₹ 20,000 respectively.

The partnership deed provided for the following :

- Interest on Capital @ 10% a.

- Ram’s Salary ₹6,000 per month and Ramesh’s salary ₹ 48,000 P.A.

- Interest charged on Drawing @ 6% p.a.

The profit for the year ended 31st March, 2022 was ₹ 6,48,500 which was distributed equally, without providing for the above. Pass the adjustment entry.

ISC ACCOUNTS Sample paper 2023-3

Question 16 [6]

RACHIT Ltd issued 4,000 , 10 % Debentures of ₹ 100 each at par. Amount payable ₹ 25 On application, ₹ 45 on allotment and ₹ 30 on first and Final call ₹ 3 per share. All duly money received on due date. Pass journal entries in the books of company and prepare the Balance sheet.

OR

BHARAT Ltd issued 12 % Debentures of ₹ 100 each at par. Application received for 60,000 Debentures. Allotment of Debentures on a pro-rata basis as follows-

30,000 applicants = 30,000

20,000 applicants = 10,000

10,000 applicants = NIL

on pro-rata basis and Excess application money adjusted with allotment and rejected application money returned. Amount payable as under:

On application ₹ 25 per share,

on allotment ₹ 55 per share,

on first and Final call ₹ 20 per share.

All duly money received.

Pass journal entries in the books of the company.

Question 17 [6]

A and B are partners sharing profits and losses equally. They decided to dissolve their firm. Assets and Liabilities have been transferred to Realisation Account.

Pass necessary Journal entries for the following:

- A was to bear all the expenses of Realisation for which he was given a commission of ₹ 14,000.

- Advertisement suspense account appeared on the asset side of the Balance sheet amounting ₹ 30,000

- Creditors of ₹ 40,000 agreed to take over the stock of Rs 30,000 at a discount of 10% and the balance in cash.

- B agreed to take over Investments of ₹50,000 at ₹49,000.

- Loan of ₹ 15,000 advanced by A to the firm was paid off.

- Bank loan of ₹ 12,000 was paid off.

ISC ACCOUNTS Sample paper 2023-3

Question 18 [10]

JSMR Ltd. Invited applications for issuing 1, 00,000 equity shares of ₹ 10 each. The amount was payable as follows:

On Application ₹3 per share;

On allotment ₹2 per share;

and on 1st and final call ₹5 per share.

Applications for 1,50,000 shares were received and pro-rata allotment was made to all applicants as follows:

Applications for 80,000 shares were allotted 60,000 shares on a pro-rata basis;

Application for 70,000 shares were allotted 40,000 shares on a pro-rata basis;

Jay to whom 600 shares were allotted out of the group 80,000 shares failed to pay allotment money. His shares were forfeited immediately after allotment.

Vijay who had applied for 1,400 share out of the group 70,000 shares failed to pay the first and final call. His shares were also forfeited.

Out of forfeited shares 1,000 shares were reissued @ ₹8 per share fully paid up The reissued shares included all the forfeited shares of Jay. Pass necessary journal entries to record the above transaction

OR

Shirsti Ltd issued for public subscription 40,000 equity shares of ₹ 10 each. At a premium of ₹ 2 per share payable as under:

On application ₹ 2 per share,

on allotment ₹5 per share (including premium),

on first call ₹ 2 per share and on second and final call ₹ 3 per share.

Applications were received for 60,000 shares. Allotment was made pro rata basis to the applicants for 48000 shares, the remaining applications being refused. Money overpaid on application was applied towards sums due on allotment.

A, to whom 3,200 shares were allotted, failed to pay the allotment money and B, to whom 4,000 shares were allotted failed to pay the two calls. These were subsequently forfeited after the second and final call was made. Pass journal entries.

ISC ACCOUNTS Sample paper 2023-3

Question 19 [10]

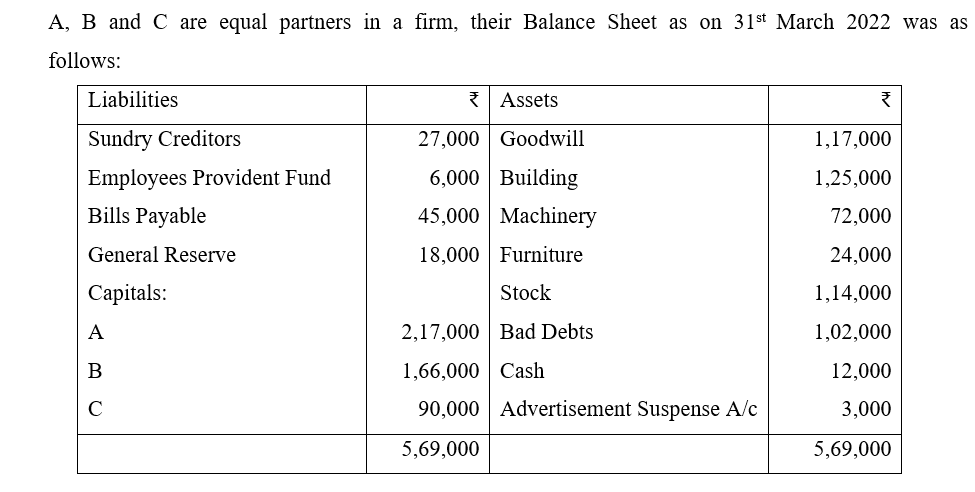

On that date they agree to take D as equal partner on the following terms:

- D should bring in ₹ 1, 60,000 as his capital and goodwill. His share of goodwill is valued at Rs. 60,000.

- Goodwill appearing in the books must be written off.

- Provision for loss on stock and provision for doubtful debts is to be made at 10% and 5% respectively.

- The value of building is to taken ₹ 2,00,000.

- The total capital of the new firm has been fixed at ₹ 4,00,000 and the partner’s capital accounts are to be adjusted in the profit sharing ratio. Any excess/Deficit is to be transferred to the current account.

You are required to prepare:

Revaluation Account,

Partners Capital Accounts, and the Balance Sheet of the new firm.

OR

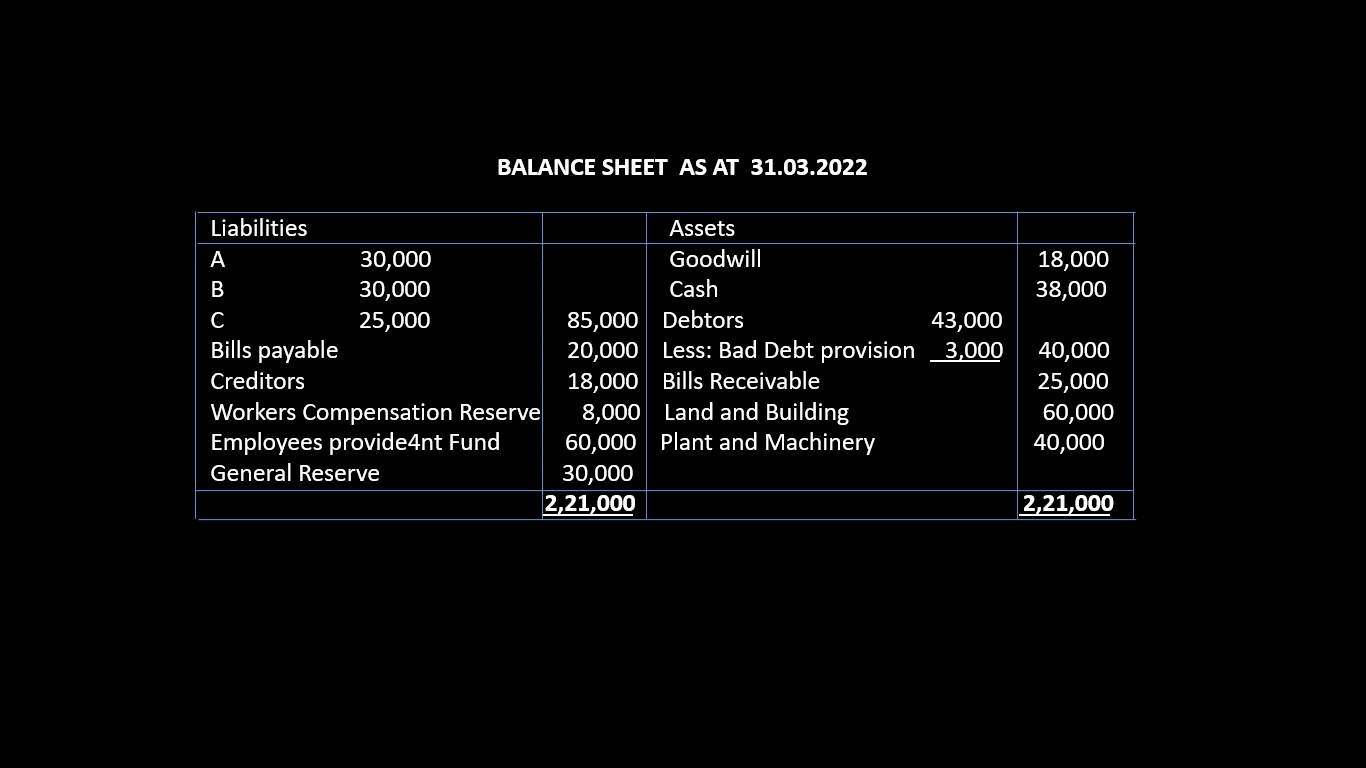

A, Band C were partners in a firm sharing profits equally: Their Balance Sheet on.31.03.2022 stood as:

It was mutually agreed that C will retire from the partnership on 1st April,2022, and for this purpose following terms were agreed upon:

- Goodwill to be valued on 3 years’ purchase of average profit of last 4 years which were 2018 : ₹ 50,000 (loss); 2019 : ₹ 21,000; 2020: ₹ 52,000; 2021 : ₹ 22,000.

- The Provision for Doubtful Debt was raised to ₹ 4,000.

- To appreciate Land by 15%.

- To decrease Plant and Machinery by 10%.

- Create provision for discount on creditors ₹ 600.

- A sum of ₹ 5,000 of Bills Payable was not likely to be claimed.

- The continuing partners decided to show the firm’s capital at ₹ 1,00,000 which would be in their new profit sharing ratio which is 2:3. Adjustments to be made in cash.

Prepare Revaluation Account, Partner’s Capital Account, and Balance Sheet.

ISC Accounts Sample paper 2023-2

ISC ACCOUNTS Sample paper 2023-3

SECTION B (20 Marks)

Answer all questions

Question 20 [1]

Paid ₹5,00,000 to acquire shares in X ltd and receives a dividend of ₹50,000 after acquisition. These transactions will result in.

(a) Cash used in Investing Activities ₹5,00,000

(b) Cash used in Investing Activities ₹4,50,000.

(c) Cash generated from financing activities ₹5,50,000

(d) Cash generated from financing activities ₹4,50,000

Question 21 [1]

Which if the following is not an investing activity under cash Flow statement?

(a) Purchase of land ₹5,00,000.

(b) Sale of plant and machinery ₹4,00,000

(c) Purchase of furniture ₹1,00,000

(d) Issue of share ₹6,00,000

Question 22 [1]

Current Ratio of a firm 2:1 and Liquid Ratio 1:6:1. Inventory ₹1,00,000. Current Assets will be?

(a) ₹4,00,000

(b) ₹5,00,000

(c) ₹6,00,000

(d) ₹3,00,000

Question 23 [1]

If total sales ₹5,00,000 and credit sales in 25% of cash sales. The amount of credit sales is:

(a) ₹5,00,000

(b) ₹4,00,000

(c) ₹1,00,000

(d) ₹3,00,000

Question 24 [1]

The main objective of trend analysis is:

(a) To indicate the direction of movement over a long time.

(b) To make a comparative study of the financial statement for a number of years.

(c) To help in forecast of various items

(d) All of the above.

ISC ACCOUNTS Sample paper 2023-3

Question 25 [3]

From the following information, prepare a comparative Statement of Profit and Loss of JSMR Ltd. for the year ending 31st March 2022, and 2021:

Particulars 31.03.2022 31.03.2021

Revenue from Operations ₹ 25,00,000 20,00,000

Purchases ₹15,00,000 12,00,000

Changes in inventories ₹ 2,00,000 1,00,000

Other Income (Dividend received) ₹ 1,40,000 1,50,000

Depreciation and Amortization expenses ₹1,60,000 1,40,000

Tax Rate @ 40%

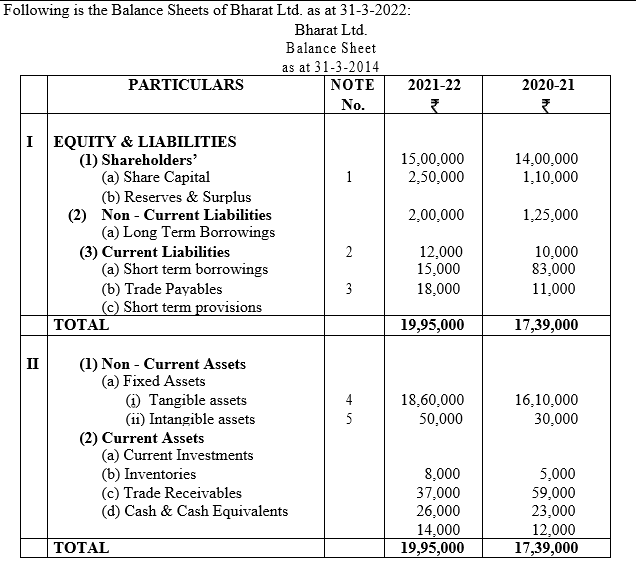

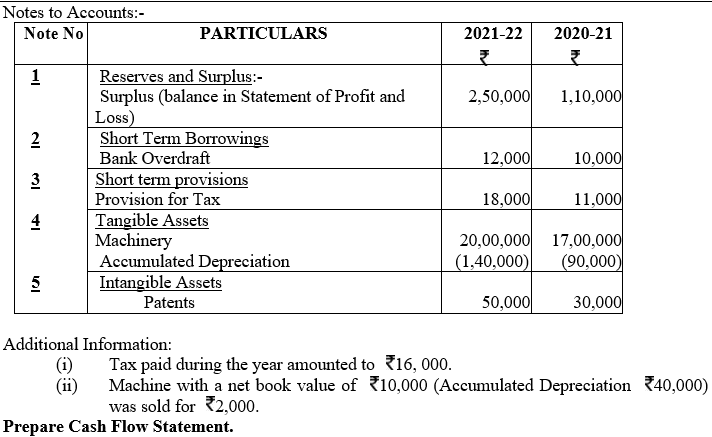

Question 26 [6]

ISC ACCOUNTS Sample paper 2023-3

Question 27 [6]

(A)Calculate inventory turnover ratio:-

Opening Inventory ₹49,000

Closing Inventory ₹ 51,000

Revenue from Operations (Sales) ₹4,00,000

Gross Profit 25% of revenue from operations.

(B) Calculate Trade Payables Turnover Ratio and average payment period:

Opening Trade Payables ₹49,000

Closing Trade Payables ₹ 51,000

Credit Purchase. ₹ 6,00,000

(C)Calculate Working capital turnover ratio:

Sundry debtors ₹4,00,000

Stock ₹1,60,000

Marketable securities ₹80,000

Cash ₹1,20,000

Prepaid expenses ₹ 40,000

Bill payables ₹80,000

Sundry creditors ₹2,60,000

Debentures ₹2,00,000

Outstanding Expenses ₹60,000

“Revenue from Operations” ₹20,00,000

ISC ACCOUNTS Sample paper 2023-3

Admission of a partner-Important Questions-1

Important questions of fundamentals of partnership-3

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4

ISC ACCOUNTS Sample paper 2023-3

Sir this is very helpful